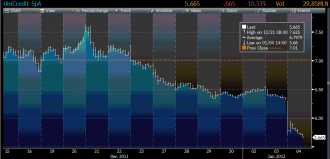

Didn’t go so hot, apparently. The stock is down 10%.

Why do we care? Because if banks can’t raise capital in the markets they will continue to shrink their balance sheets. That means they will make fewer loans, will sell existing assets and generally continue to deleverage.

That deleveraging process has mixed impacts on the euro. It hurts the economy from a macro sense as it crimps credit drastically. It helps underpin the euro to an extent on the FX market as overseas assets are shed and capital is returned to Europe. Lately, the macro picture has dominated repatriation flows.