Ireland’s central bank hiked its growth forecast for 2012 to 0.7% from 0.5%.

Ireland was swamped by a banking and real estate crisis but the economy remains competitive and has performed much better than its southern neighbors.

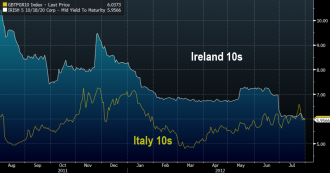

Irish borrowing costs have now fallen below Italy.

On the surface you can say: Ireland did it so the rest of Europe can as well

But it’s not that simple. The Republic of Ireland is a tiny country with just 4.5 million people and it ascribes to what I call the Delaware model. It employs an extremely low-tax system (with the added bonus on an English-speaking population) to attract corporate headquarters.

If other European jurisdictions tried to emulate the model and lowered tax rates to similar levels they would wipe out Ireland’s economy but the job creation wouldn’t be enough to make a difference in more populous countries.