Any time you have a two-day 10% drop in a widely-held asset there will be reverberations.

The fall in gold is especially spooky because it has no intrinsic value and it’s widely held with borrowed money. What we’re seeing today (or will see soon) are leveraged funds being forced to liquidate positions. As the weakest hands rush to the exits they’re pulling down the strongest hands with them.

The strongest hands of all are central banks and you can be assured they’re not selling here (except Cyprus perhaps). What’s interesting is that there are no signs of central banks buying; there aren’t even rumors about central bank buying.

For years on any dip there has been chatter about buying from central banks in Asia or the Middle East. If they’re getting out of the gold-buying game, it could still be a long fall from here.

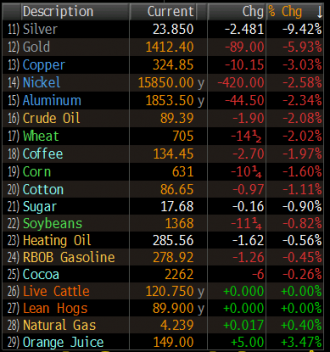

We have certainly seen signs of panic-selling already but falls like this often continue. Entire funds can blow up as margin calls come in and that forces them to sell other assets. That’s what we’re seeing across the commodity complex today as everything (save OJ and natty) gets thumped.

So you’re saying we should buy orange juice?