Following on from some jovial comments on beer prices yesterday, I’ve had a look and found that liquid refreshment is a great indicator of growth and consumer confidence.

Unsurprisingly, like stocks it’s a double win bull market (bad earnings, up on QE, good earnings, up on fundamentals) as people turn to drink when things go bad and turn to drink when celebrating the good times.

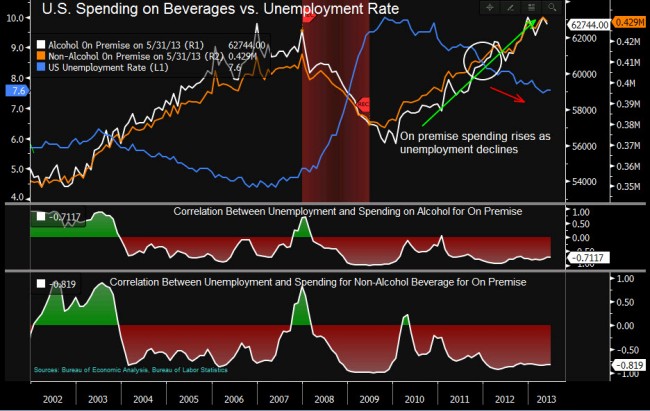

Have a look at US beverage spending vs the unemployment rate. Spending slumped over the crisis but picked up when unemployment was at it’s worst and has continued up since.

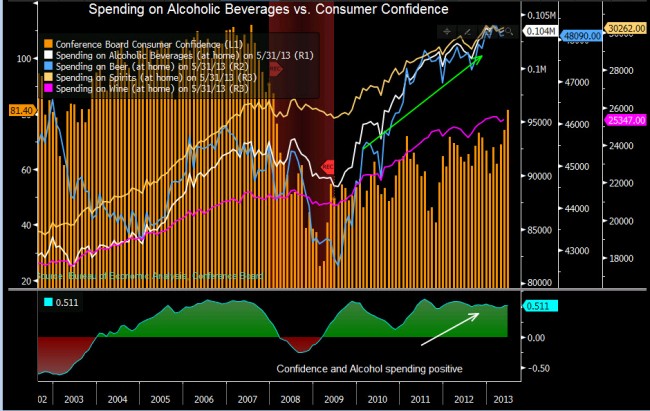

It seems that consumer confidence is matched by the level of alchohol purchases. In the UK it would certainly add to increased retail sales in curry and other take-a-ways.

If you don’t feel confident in the global economic recovery you can always hedge into beer credit default swaps which nearly matched Greek CDS for volatility.

For investment purposes European large cap brewers outperformed the stock market by 24% in 2012 and by an average of 11% for the ten years prior, according to SAB Miller’s global beer market trends.

Of course the most important numbers to note is how much a pint will actually cost you anywhere in the world.

Look here to find where you’ll get most bladdered cheapest; Pintprice.com

If I ever have the pleasure of meeting any of you in Tadjikistan, I will happily buy you a drink… just a half mind

Cheers