While the recent interest rates increase in Brazil to 8.5% along with other price hikes has created domestic unrest across the country that has been called the “Brazilian Spring” by some, for international currency traders there is reason to rejoice. In the current low interest rate environment, there has been a strong need for the profitable carry trade that used to exist with the Brazilian Real. With interest rates rising now, it has returned, with foreign currency traders cheering in front of their Bloomberg terminals across the globe.

Profiting from carry trade transactions is fairly basic as the returns should relate to the relevant interest rates. For example, the short-term interest rate in American dollars is about 0.25% and the comparable rate in Brazil is now 8.5%. Based on that, The Greenback should appreciate against the Real by more than 8%. Borrowing in low interest rate countries and then investing in high interest counties has always been a profitable endeavor for hedge funds and other asset managers.

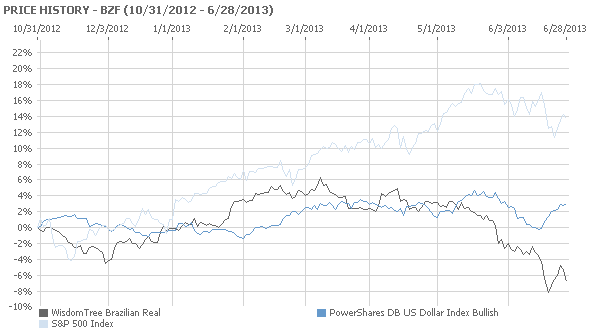

The chart below shows how the Real (BZF) has declined against the US Dollar (UUP), allowing for those carry trade profits to be booked:

The main question now is how long that will last in Brazil this time. Before, as one of the BRAC nations, Brazil was booming, chiefly due to raw material exports to China. But now, with China’s economy in a slump with growth down to 7.5% from the previous double digit average, there is not the strong demand for Brazilian commodities there was before.

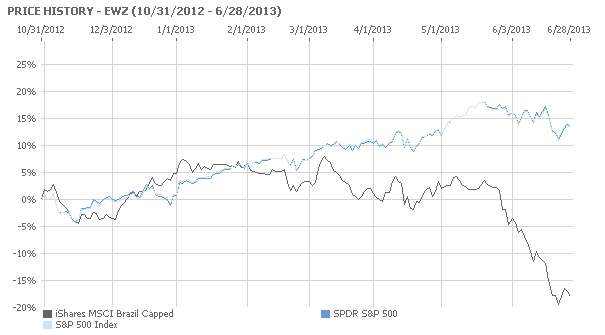

The chart below shows how the main Brazilian exchange traded fund has slumped against the Standard & Poor’s 500 (SPF) exchange traded fund:

In addition, there is tremendous domestic demand in Brazil. The 2016 Summer Olympics and the 2014 World Cup are being held in the country, which has resulted in massive construction projects. Petrobras (NYSE: PBR), the biggest publicly traded company in Brazil, is undergoing a $237 billion expansion program, the largest in the world. As a basis of comparison, the economic stimulus launched in China last year was for $186 billion.

That amount of government spending naturally results in inflation.

The traditional monetary policy response to inflation as always has been to raise interest rates. When an economy is booming, that can be endured. But that is not the case in Brazil, so the recent rounds of interest rate increases along with price hikes for bus, train, and metro tickets have led middle class protestors to the streets of San Pablo, Brasilia, and more than 100 other cities around the country.

Unwinding a carry trade can be a very painful, expensive experience.

Brazil has the World Cup coming next year, so any domestic unrest can expect to be settled by then. That means the outlook for continuing high interest rates should not be relied on for long term profits, as has happened before. It is likely that steps will be taken to lower interest rates and other costs to meet the demands of the protesters in Brazil, which will lead to a hue and outcry when foreign currency traders around the world have to unwind their positions