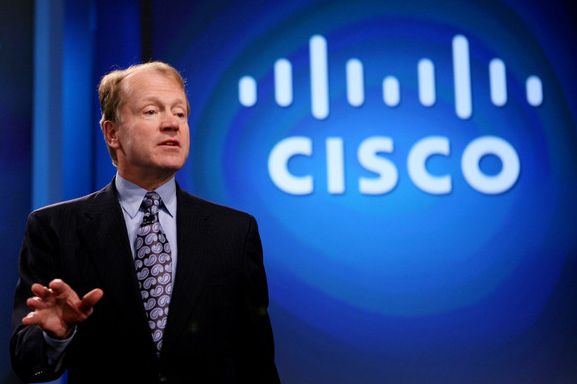

Cisco CEO John Chambers is a forex trader’s best friend. He has great insight on the global economy and a long track record of honesty. When he talks, listen:

“Last quarter, I described a continued slow recovery,” said John Chambers, Cisco’s chief executive. “This recovery is more mixed and inconsistent than others I’ve seen.”

He announced 4,000 job cuts, saying growth had fallen short of what he thought a few months ago:

“What we see is slow steady improvement, but not at the rate that we want,” Mr Chambers said. “We have to very quickly reallocate resources.”

Share prices are down around 10% in after-hours trading. What he’s saying doesn’t fit with the latest economic data but Cisco has access to the leading edge of the economy and Chambers has been right many times. I’m going to take a night to digest it and look for more comments but what he is saying is making me reconsider some things I believed about the global economy.

Is Chambers saying to buy JPY?