This might be something for one of the mountain of economics PhD’s out there to study that could actually get some results.

I have been pawing through the latest Bank of Canada Review, it’s a quarterly summary of economic research at the bank. It’s usually bland but the latest issue has some good articles. In particular, one looks at big data and how central banks could use it for forecasting.

Since accurate and timely information about the current state of economic activity is important for monetary policy decisions, big data provides the opportunity to improve current analysis by exploiting digital data from economic transactions as well as by measuring consumer sentiment from social media and Internet searches. For example, existing monthly indicators could be combined with big data to predict GDP growth before official National Accounts data are released for a given quarter.

They talk about using computers to crawl prices listed on inflation, trading electronic payment data, Google searches for unemployment programs. They summarize some of the research and it’s exciting stuff for wonks.

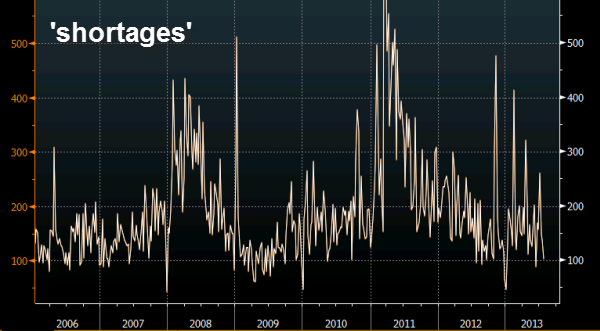

One of the oldest methods the cite is the correlation between instances of the words ‘shortages’ in the news and inflation. I don’t see it:

Compared to CPI: