A Bank of America/Merril Lynch Global Research report finds that consumers in the US are switching from purchasing imported goods and services to domestic… and that this will likely lead to USD strength.

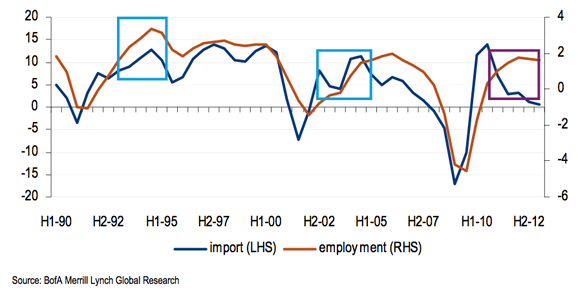

- Real import growth has fallen to less than 1% in H1 2013 from 11% in H1 2010, a huge drop

- Employment growth has gone from -1.7% to 1.6%

US real import and employment growth, y/y %

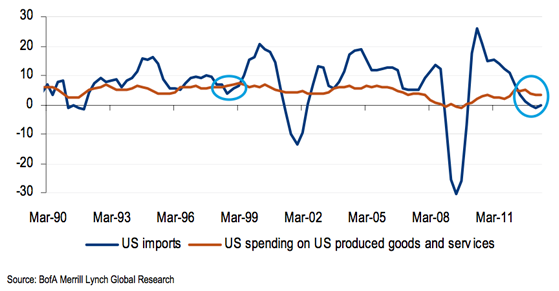

- The faster growth in purchases of domestic goods and services is unusual:

US spending on imports vs. domestic y/y %

The reports notes that it is propelled by:

- Rise in US energy production

- An increase in US manufacturing

- Aging baby boomers spending more on medical, food services, housing

The report concludes the moves are favouring ‘domestic labour intensive sectors’

The report’s author, David Woo, head of global rates and currencies research, said in an interview that the increase in spending on domestic goods can create employment in the US, which may push down the unemployment rate closer to the Federal Reserve’s unemployment threshold (currently at 6.5%) for a change in interest rates … a hike of which could lead to a higher USD.