There are two problems in China at the moment.

- Chinese bad loan writeoffs

- SHIBOR

Chinese banks tripled bad loan writeoffs to 22.1 billion yuan and that has sparked some fear. Westpac says the move is more about a change in management style from the country’s leadership.

Chinese banks are obliged to gain ministerial approval before writing off assets, this latest action can be seen as a sign that the authorities are willing to accommodate more frequent bad loan disposal as ‘business as usual’. The old way – let NPLs accumulate for too long without action, before engaging in an expensive system wide recapitalisation – may not fit with this cycle under a reformist leadership.

There is nothing to worry about with non-performing loans at 1.0%.

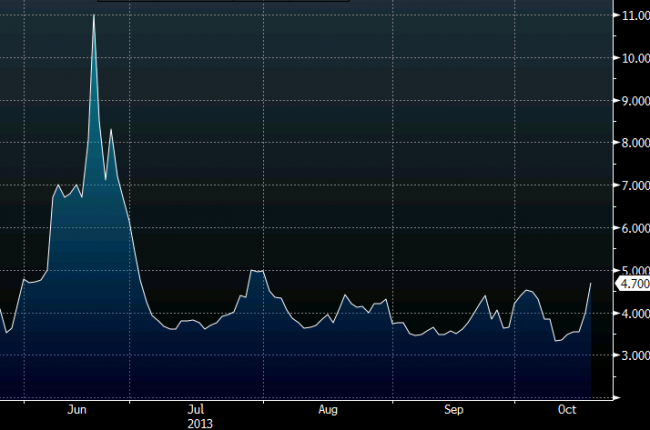

The scare in SHIBOR at the moment is in 7-day rates but all short-term rates have moved higher. The quick full-point rise has been unwelcome but this chart puts it into perspective.

7-day SHIBOR

In June there was real reason for worry and Chinese stocks blew out for a few days. There is no need for alarm this time. Westpac says this could also be part of policy reform.

With the PBoC frequently active on both sides of the liquidity equation this year, a ‘revealed’ rate corridor similar to those of other emerging market central banks is forming, which is a necessary development on the path to price based liquidity management.

I’m in the camp that the Australian dollar selloff is a normal retracement from overbought conditions but if the problems in China are the biggest reason the market can find to sell Australian dollars, this dip will be awfully shallow.