Will Japan finally get out of its two decade slump?

I have been in the markets for over 20 years and I have heard that Japan is finally “recovering” from the very beginning of my career. Clearly all those instances have been false starts but this time there are some key differences.

That great song comes from 1984 – a time where Japan was still economically dominant – remember all the textbooks written about Japan’s economic miracle? But Alphaville’s great song also includes the apt lyric “Here’s my comeback on the road again”.

Will the Abenomics “comeback” this time prove more lasting than all attempts to reignite the economy before? That is the ¥500 trillion question (the market cap of the Nikkei).

The Japanese stock market is up over 50% in the last 12 months, rising from 9000 for the Nikkei a year ago to around 15,000 now. However most of the performance has been between November 2012 and May 2013. Since Bernanke’s June taper comments, the Nikkei has been trading sideways:

One year chart of the Nikkei 225

The chart for USD/JPY is well correlated to equities, with yen weakness corresponding to equity strength. The yen has significantly weakened from trading at around 80 yen to the dollar this time last year to around 100 yen to the dollar now. However again, most of the move was between November 2012 and May 2013. Since the Fed taper comments, the yen has moved sideways:

USDJPY one year

So will Prime Minister Abe finally get Japan out of its economic slump or does the recent stock market weakness (and yen torpor) suggest that that Abenomics, like so many previous attempts to reignite the economy, has already run out of steam? Or is this Nikkei weakness an opportunity to get back into the story?

Well this week we’ve seen both opinions come from professional investors. The British Private wealth manager Coutts cut his position on Japanese equities from overweight to neutral on fears that Prime Minister Abe will not deliver his “third arrow” – the much needed reform to the Japanese economy (the first two arrows are monetary policy and public finance). Also this week, billionaire hedge fund manager Daniel Loeb reiterated his optimism for Abenomics: “We believe Premier Abe has the best chance in over a generation to enact the reforms to push Japan forward. If he acts on these initiatives, we will be eager buyers of additional Japanese stocks….” That was from his hedge fund’s third quarter investment letter published Tuesday. Third Point’s performance has benefited significantly this year from the Japanese macro trade and the letter confirms that “Japan is at a crossroads” and that so far Premier Abe’s policies have worked: “(the) arrows (have) landed on target and inflation has risen (albeit modestly)…. The government’s resolve to enact the third arrow of structural reform appears intact”. However the letter warns on reform that “the government remains short on specifics”. Credit Suisse also reduced their overweight recommendation in Japanese equities earlier this month (to increase the weighting in European equities).

So who to believe?

The economic turnaround has been pretty dramatic. In 4Q 2012, the economy contracted at an annualised rate of 3.6% and the 1Q expanded at an annualised rate of 4.1%. That is a 7.7% annualised improvement – no surprise equities did well. However 2Q disappointed with an annualised 2.6% expansion (3.6% had been expected). And the fear is that 3Q and 4Q may reinforce the slowdown. On top of that the Fed’s continuance of QE has kept the pressure on the dollar and so yen weakness alleviated.

The key to Japan’s future is reform. Japan has many rules and regulations restricting competition particularly foreign involvement in the economy and little has changed over the last 20 years.

Reform requires massive political commitment

Industries and their employees will fight hard to protect their interests. Just look at Margaret Thatcher’s fights in the 1980s, especially against the coal unions. It is always the case with reform that the few that benefit a lot from protection will fight harder and more vocally than the many that benefit from liberalisation, most of whom won’t even realise the benefits to them from lower prices, greater competition and higher growth. The political rulers need to have the stomach for the fight for reform and the backing of the electorate. This time it seems Japan may be ready.

Premier Abe came to London this summer and at the invite of Mayor Boris Johnson he gave a speech at the Guildhall in June. The transcript is worth reading for anyone with a position in the yen, JGBS or the Nikkei.

In the consensual world of Japanese politics, it is hard hitting (even if for a British audience). Premier Abe:

“We had been unable to root out deflation because Japan had been lacking strong political will…What I would like you to take home from my address today boils down to this single thought: that my economic policies are backed in all respects by my political will”.

He was adamant that Japanese growth and recovery is crucial for the stability of the world (the Japanese economy is as large as Germany and the UK combined). He pointed out that since 2007, Japan has lost $500 billion of gross national income – equivalent to an economy the size of Poland or Norway. “For that kind of country (Japan) to contract (further) would already be in my view a cardinal sin in itself”.

And it is the need for reform – his third arrow – that he talks about most. In fact he quotes Margaret Thatcher – “this is a case of TINA – there is no alternative”. He tackles the need for Japan to be more open, more competitive and more innovative.

By 2020, he wants to double foreign investment, encouraging overseas capital into the country. According to an article in the Nikkei weekly, foreign direct investment in Japan as a percentage of GDP, is lower than in the U.K., U.S. and South Korea. Premier Abe talked about the need to encourage small entrepreneurs so they are as successful and prolific as in the USA. In particular on the need for liberalisation and more competition he highlighted the electricity industry: ”We have learned a great deal from Europe’s history over more than two decades of liberalizing and then opening up the electricity market, splitting the systems for power generation and power transmission, and tying in and integrating electricity markets….. I took the decision to liberalize the electricity market….. thereby putting an end to a market oligopoly that has continued for more than half a century”.

And more deregulation is promised: “… we intend to deregulate thoroughly areas known as National Strategic Special Zones”. These deregulated zones areas are to be as business friendly as possible in order to attract foreign capital (which has not always felt welcome in the country).

Some of the rules and regulation shutting out foreigners are also to change: increasing the hiring of non-Japanese Doctors and University professors for example. Also more controversially he blames the sexism at the heart of the country for its economic failure: “…it’s possible that Japan’s stagnation is essentially men’s fault. The period in which men with uniform ways of thinking dominated Japan’s business community was too long. In contrast, women have been engaged in corporate management for much too short a time…. I am determined to encourage women to break through the glass ceiling”. These measures are aimed at improving labour availability and productivity in an aging work force, encouraging use of the 50% of the population who happen to have XX chromosomes and the non-Japanese. However employment regulation is still very strict, for example, with government payments to prevent companies laying off staff. Premier Abe tried to liberalise the labour markets before in 2006 and 2007 and failed. Whether he will be more successful this time remains to be seen.

And finally Premier Abe stresses the need to resurrect innovation: “to reform university education.. I would like to have at least 10 Japanese universities appearing within the rankings of the world’s hundred best schools”. He wants to promote questioning attitudes and curiosity rather than rote learning. Easier to say than to change.

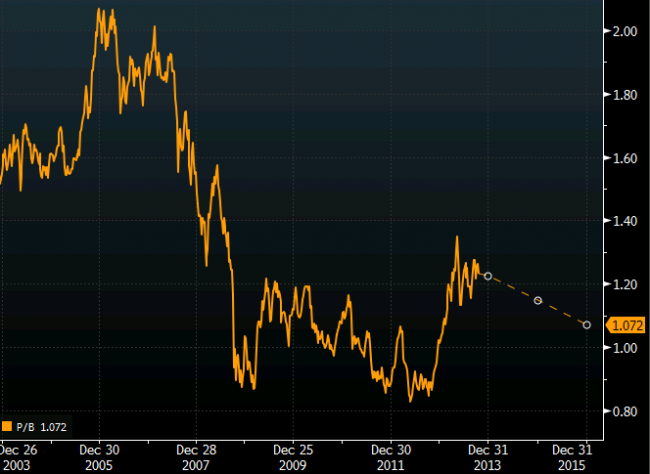

So how much of this optimistic view is priced in? There is some scepticism around the lack of details in his reform plans and his ability to enact them. But clearly Japan’s stock market is not as cheap as was and is pricing in some better news. But how much? According to Bloomberg the Topix is trading around 1.25 times book value which is not exactly expensive:

Topix price to book ratio

Therefore I question the assumption that a lot of good news is already priced in, even despite a 50% rally. If this is finally the resurrection of Japan a move from 9000 to 15,000 is just the start, given market has collapsed from almost 40,000. This pause is classic investor behaviour. For those in at the beginning, a 50% return ensures profit taking and for those that missed the rally, they do not want to get in at “elevated” levels. Hence the pause. But big market moves – a real bull market – continues for years. And of course, no one can time a market perfectly.

What though is missing is Japanese confidence in their economy and their stock market. According to Credit Suisse it has been foreign buyers driving the market higher and the Japanese still hold over half their financial assets in cash. However in January of 2014, Japan will launch its version of the British ISA scheme that offers tax free savings in the stock market. The Nippon Individual Savings Account is a tax free wrapper for stock market investments. The NISA could persuade the Japanese to put their huge quantities of cash into the equities. Nomura certainly thinks so, expecting the Japanese to put $690bn into NISAs. And Japanese households have very low holdings in equities – just 7.9% of household assets as of March, compared with 34% in the U.S. and even 15% in the euro zone (source Bank of Japan and Bloomberg). Given that Japanese households have $8.5tn of bank deposits (same sources), there is plenty of cash that could be invested in the stock market. That could be the big boost.

Getting the economy going may be a huge job but it is only the start. The country still has an over 200% debt to GDP ratio. Growth and inflation normally comes with rising interest rates, which makes the debt burden unmanageable. This is a Herculean task Premier Abe has set himself.

But if you still are not convinced that of his commitment? Premier Abe is: “I have positioned the next three years as a period for intense reform. I will be afire, burning with all the political strength I can muster. Japan’s regulatory regime is like solid bedrock. I myself intend to serve as the drill bit that will break through that bedrock. If I am unable to make Japan a great country and a robust country this time around and pass it on to the next generation, then there is no meaning to the life I have lived thus far”.

That is fighting talk from a leader of any Nation and is the reason I would caution any shorts…