Twice a year the Bank of Japan releases an update to its three-year forecast for economic growth and prices. The last one was back in April, and we get the latest tomorrow:

- Most attention will be focused on the bank’s forecast for the core consumer price index for the fiscal year ending in March 2016 … ’cause they all keep telling us it will hit its 2% inflation target during that period. If the BOJ revises the target down for that date then we might reasonably expect further easing (leading to a stronger Nikkei and a weaker yen, you would think). If, on the other hand, they revise the target up, then it argues for no probable further easing.

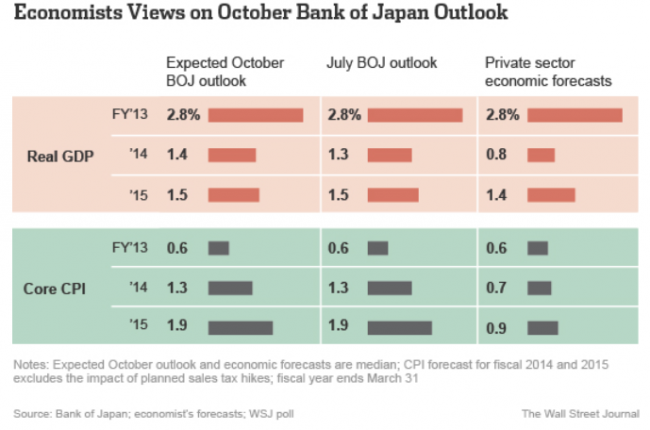

- A poll of 13 economists shows 9 see the BOJ’s policy board sticking to its current view that the core CPI will rise 1.9% in fiscal 2015, the other 4 expect the forecast inching up to 2.0%.

- But economists forecasts for median core CPI for the year ending March 2016 is less than half of what the BOJ expects!

- 10 of the economists expect the BOJ to revise its economic growth forecast to a range of 1.4% to 1.7% for the year ending March 2015 (from the current 1.3%).

- 3 see the BOJ raising its growth projection for the year ending March 2016 to 1.6% from 1.5%

Also:

“The BOJ may lay out bullish projections in order to influence market expectations,” said Junko Nishioka, chief economist at RBS Securities, adding that the bank may be hoping to raise inflationary pressure that way. The BOJ may feel the pressure to do so in part because Prime Minister Shinzo Abe’s structural reform plans have fallen short of market expectations. That has dampened optimism over Japan’s growth potential … Many BOJ watchers believe that the bank will be forced to take additional easing steps, likely between next spring and autumn.