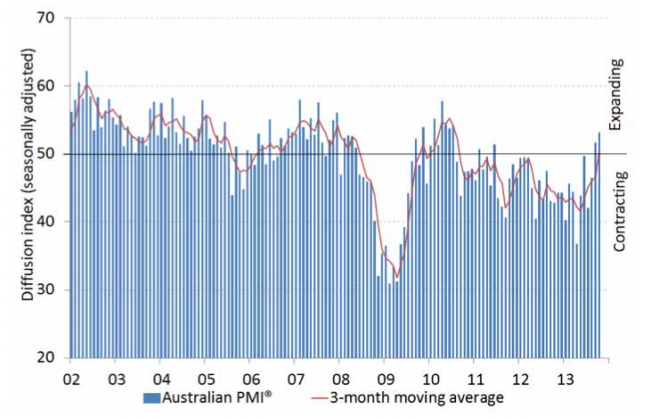

- AIG Performance of Manufacturing for October is up 1.5 points to 53.2

- Second consecutive month in expansion territory (above 50)

- Highest since July 2011

- Stronger readings (& above 50 points) for new orders and production sub-indexes

- Employment sub-index still in contraction, at 48.6 points

- Expansion strongest in food, beverages and tobacco sub-sector

- Metal products and machinery and equipment sub-sectors continue to show contraction

- Exports sub-index is still at very low levels, indicating ongoing export contraction

“While there are certainly encouraging signs, it is too early to call a recovery with a good share of the gains representing a catch-up following a very slow mid-year period,” said AIG chief executive Innes Willox.

If you were on the board of a central bank in Australia and you saw manufacturing tentatively improving, good expansion in building approvals, sentiment/confidence improving, and house prices rising you may very well think that you wouldn’t want to go cutting interest rates again, that the easing cycle could well be over, and maybe even the possibility of hiking them would be starting to nudge onto your radar (although its too early for that still). I would think that if you were on the board of a central bank in Australia and you were heading into a policy meeting next week (oh, I don’t know, say on Tuesday the 5th), you’d be very much inclined to leave rates on hold.

You would want to see how the external economic environment is performing, though, and would want to be paying attention to Chinese manufacturing PMIs later today as a bit of an indication.

No?