It’s looking more and more like the most-recent RBA rate cut was the end of the rate cutting cycle.

Retail sales data earlier today was much stronger than expected and the Chinese economy continues to hum along. The rate risks are now to the upside, especially if Fed printing leads to another run of the commodity bull market.

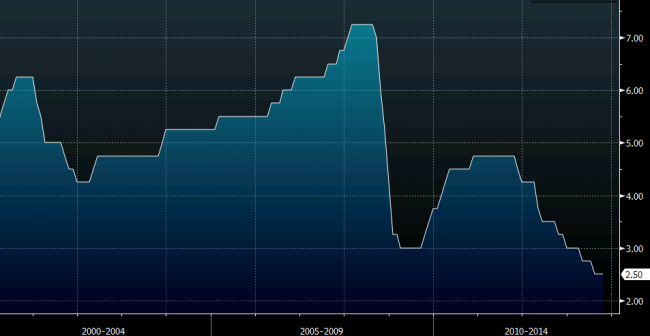

RBA expectations are especially tame

Overnight Index Swaps are pricing in 10 basis points of tightening over the next 12 months. It’s already been nearly 3 months since the RBA cut in August so we’re expecting about 15 months of unchanged rates at 2.50%.

Historically, that’s would mark a big change. The bottom of the rate cutting cycle in 2008-2009 lasted only 5 months and the 2000-01 cycle trough was just four months. but the RBA decision is Nov 5 and if Stevens signals optimism about the economy, the Australian dollar could start to price in hikes sooner.

RBA rate history