Goldman Sachs has lowered its forecasts for the loonie.

They see USD/CAD at 1.07 in three months, 1.10 in 6 months and 1.14 in 12 months. Their previous forecast was parity in 12 months.

They say the trade is “very sensitive” to Fed tapering which is expected to start in March but could come sooner. When the taper comes it could push the pair above the 1.02-1.06 range.

They also warn of the risk of a rate cut in Canada if inflation stays low. Today’s CPI report showed Canadian inflation at just 0.7% year-over-year.

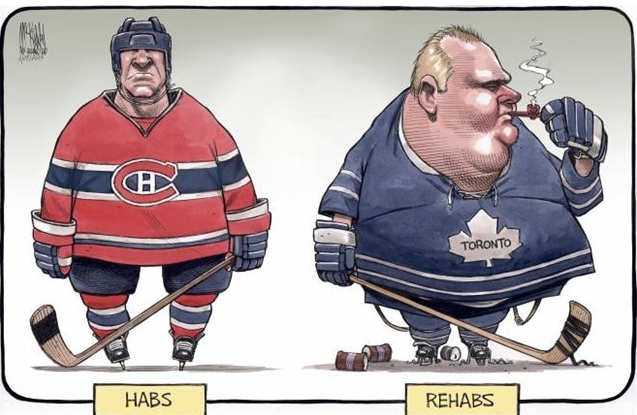

The 14-cent cut in the 12 month forecast can only be explain by Goldman’s discovery that Canada is run by crackheads (and of course, Goldman’s more of cocaine kinda crowd).