Not sure what to make of things at the moment USD/JPY hasn’t exactly shot into space on a break of 101 and that may be down to Kuroda seemingly happy with the level now. The yen crosses are well supported with the pound and euro moving up also. USD/CHF is going through the floor with EUR/CHF, while the aussie and kiwi fall as commodities rise. Everything feels a little disjointed and I remember the same sort of thing happening when the taper trade reared it’s head back in September.

When markets get like this it’s usually a sign of the tides changing. It could be the taper expectations it could be the improved US data or the worries over European inflation, but it’s looking a bit muddled at the moment and that can make things difficult in trying to fathom trends.

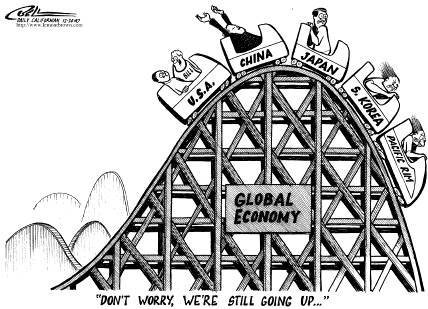

If the taper trade is coming into play ahead of the December Fed meeting then opportunities may arise that we missed last time. Emerging market currencies like the rupee and rupiah are still elevated and are looking to turn higher and Indonesian indices are falling once again. If it follows the pattern it did last time the flows out might intensify the nearer to December we get. One of the big moves touted for 2014 is emerging markets recovering. I mentioned previously that that the global economy is like a roller coaster with different areas in different cars. As one end is rising up the track towards growth, the rest may still be coming down the slope behind. If the US recovers then it will have an effect of pulling the cars behind it up the track. If you want to get into EM trades, and the taper sees flows out of Asia then that may give you a lower point to buy into.

These effects may well be playing out in the commodity countries also. While the first instant of a taper may trash the pairs in broad dollar buying, the long term picture says that with rate rises on the cards and the knock on effect of investment picking up from global growth recovering, short term moves may again provide a decent long term buying opportunity.

As we’re fond of saying it’s all about watching the prices for clues and trying to decipher where the next big moves are going to take place. If you’re a long term player then this could be the moment to get set up in some trades. If you’re a short to medium term punter and want to play the taper, then a broad dollar long position should be your game. Want to play deflation in Europe then shorting the euro is the play.

Either way my gut is telling me that the market maybe starting to place itself for various events, which in the short term could mean moves that go against the everyday grain. The year end is only just over a month away and as usual it will be a time when people start to make plays for the new year.