BNP Paribas is spreading fear but they make a good point

BNP is out with a note today, warning about the longer term dangers in the economy, here’s the jist of it.

“The chances of avoiding a recession before 2020, with monetary policy at zero bound and balance sheets strained, are minimal.”

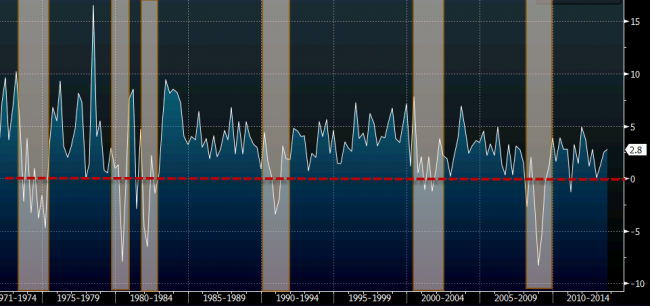

It doesn’t really matter which economy they’re talking about because the conclusion is the same. Look at US history, there has been a recession in every calendar decade for as long as the record go back.

US recessions

What’s different this time is that monetary policy (and probably fiscal policy) are no longer capable of acting as a counter-balance. Central banks are played out and there is no appetite or ability to spend in developed countries.

Take Spain. The country has been in recession for 5 years and in that time debt-to-GDP has risen to 84.1% from 36.1%. How bad would it have been without that spending? Another recession might not be triggered by a massive credit crunch but even a mild shock may spark a stubborn contraction if governments refuse to spend.

As BNP says:

If we do see another recession, then the current taste for the austerity/growth/forbearance solution could crumble and more radical alternatives may come onto the agenda

They start the sentence with if but a recession is coming, it’s a matter of when. Zero interest rates and government debt aren’t disappearing; when the next recession hits, it will be brutal and probably radical.