- Prior 55.4

- Employment index 52.5 vs 56.2 prior

- New orders 56.4 vs 56.8 prior

- Business activity 55.5vs 59.6 exp. Prior 59.7

- Prices paid 52.2 vs 56.1 prior

That should get the taper bus going into reverse.

There’s some bright spots in the report. New export orders were up to 58.0 from 53.0 in Oct while Imports stayed unchanged at 55.0. Inventories and backlogs fell slightly also.

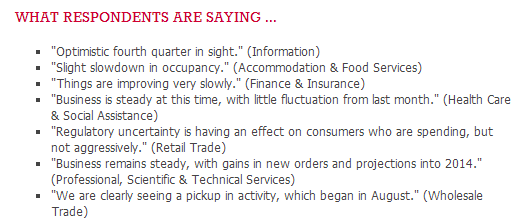

The comments from respondents are a little flat though.

Dollar has given some back on the soft report withe USD/JPY at 102.50 from a data drop to 102.33

Once again, and with my yank bashing stick back in the umbrella stand, employment falls again. I’m getting the feeling that there is some disparity between these index employment numbers and the jobs reports we are seeing. I don’t know if there’s some lag but it’s not painting the rosy picture we’re seeing elsewhere.