EUR/CHF has just run some small stops through 1.2250 down to 1.2242 1.2240and that comes after swiss CPI data which has taken out the threat of deflation for a moment.

Here’s the orders and I’ll look into the moves in greater detail after.

Bids seen at 1.2240, 1.2235, 1.2220, 1.2215

Offers at 1.2280, 1.2290, 1.2300, 1.2310, 1.2330

USD/CHF

Bids 0.8950

Offers 0.9000, 0.9020, 0.9030, 0.9050 (stops), 0.9090, 0.9100

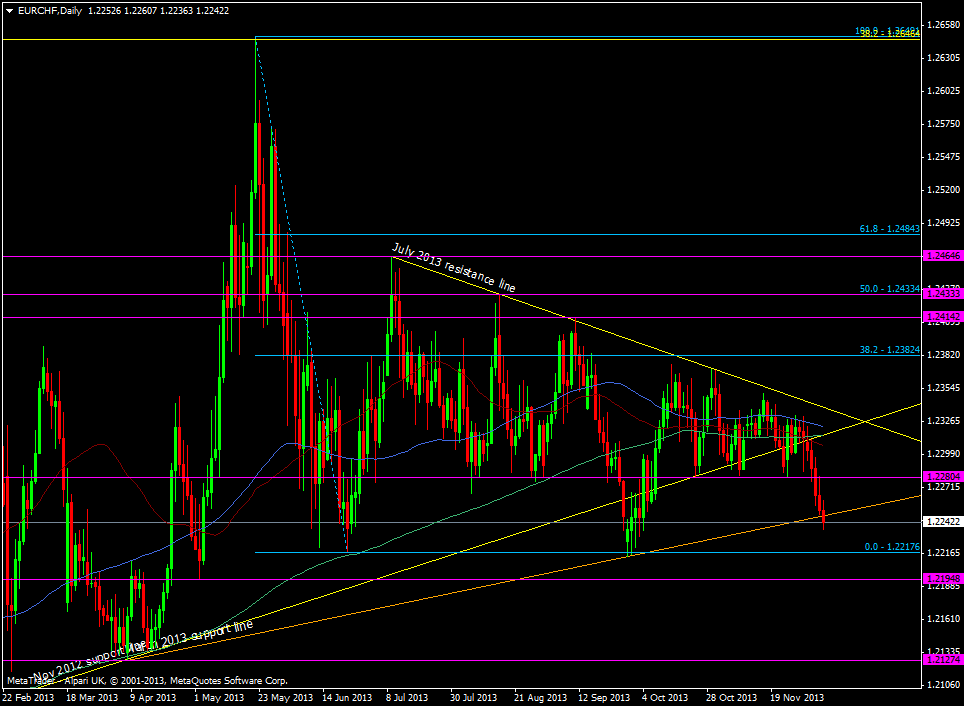

We’re on the way to the June and September lows at 1.2212/17 and then we have the April low at 1.2195.

EUR/CHF daily chart 06 12 2013

As expected 1.2280 acted as resistance after we broke through and is likely to do so again on another attempt.

The SNB is stuck between a rock and a hard place as if inflation rises then they may have to switch to a hawkish tone on rates. That means upward pressure on the franc which puts the peg in focus. It’s a race between them and the ECB to see who reacts first and but it’s the data that will decide. We’re in a period of low inflation but the euro zone can weather fairly large moves in inflation more than Switzerland can.

For those who saw Nick’s post last night How I made money on 89 consecutive forex trades, and who trade this from the long side, this will be another opportunity to pick up some low hanging fruit. There have been comments about how nervous people have get the nearer to the peg we get but I look at it from a different perspective. The lower to the peg we get lowers the amount you will risk on trades bought towards it. Of course this is with having faith in the SNB.

As I’ve said many times it’s not often you can trade with a central bank watching your back and where you know the downside limit. Yes there is a risk the peg might be attacked and get blown but if you manage your trades as you would any other then it shouldn’t do you much damage. The rewards far outweigh the risks as far as I’m concerned.