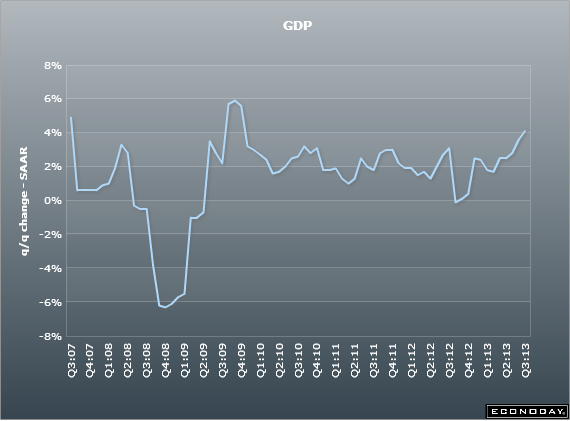

- Prior 3.6%

- Sales 2.5% vs 1.9% exp prior 1.9%

- Consumer spending 2.0% vs 1.4% prior

- GDP deflator 2.0% unch

- PCE prices 1.9% vs 2.0% exp. Prior 2.0%

- Core PCE 1.4% vs 1.5% exp. Prior 1.5%

- Exports +3.9% vs 3.6% prior

- Imports 2.4% vs 2.7% prior

A big kick up in the final Q3 read and a big boost for consumer spending which had been one of the weaker components of the economy.

PCE prices a tad lower adding to the weaker inflation picture.

Q3 Corporate profits also revised down to 2.4% from 3.3% exp. Prior 2.6% (5.6% vs 5.8% prior y/y) which shouldn’t be a good sign for stocks. Not that stock prices reflect actual fundamentals (flogging a dead horse)

Dollar takes a leap rising to 104.63 in USD/JPY, 1.6316 in Cable and 1.3632 in EUR/USD

US Q3 GDP final 20 12 2013

Also of note, business investment was revised up to 4.8% from 3.5%, interllectual property and software +5.8% from +1.7% and within consumer spending durables rose to 7.9% from 7.7%.