Both BOFA and RBC say that there is an increased risk of an accompanying statement from the MPC when they make their rate decision this Thursday.

Expectations are already ramping up on when the first hike in rates will be.

Here’a run down of current feelings in the market;

- Citigroup and Morgans say markets may be getting too ambitious in the timing of rate rises

- Goldman and RBC say we may get a revision to the unemployment threshold at the Feb inflation report

- BOFA says GBP may suffer if additional guidance reinforces that unemployment is a threshold and that going thorugh will not imply imminent rate hikes

- Goldies say that macro-prudential tools may come into play before conventional policy but doesn’t see rate rises until Q3 2015

- JPM switches forecast for rate increases to Q1 2015 from Q3. Doesn’t expect changes to forward guidance

- UBS is also going with Q3 2015 as the first date of rises and unchanged FG

- RBS say the meeting will be uneventful

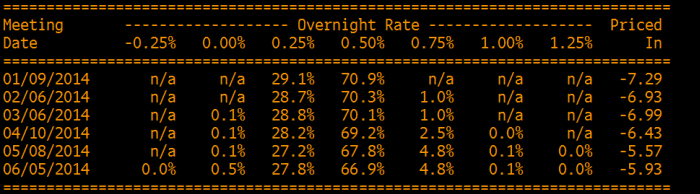

Here’s the latest OIS implied indicator for the next few meetings.

BOE OIS implied interest rates 06 01 2014

I think we can safely say there will be no change at the meeting and I very much doubt they will be any statement made as H R Carneyness will wait until the Feb inflation report to air his laundry. That said, since he pulled that particular rabbit out of his hat at his first MPC meeting there’s always been a niggling possibility of doing it again. If it was his cunning plan to keep the market on it’s toes it’s worked on me, the cheeky monkey.