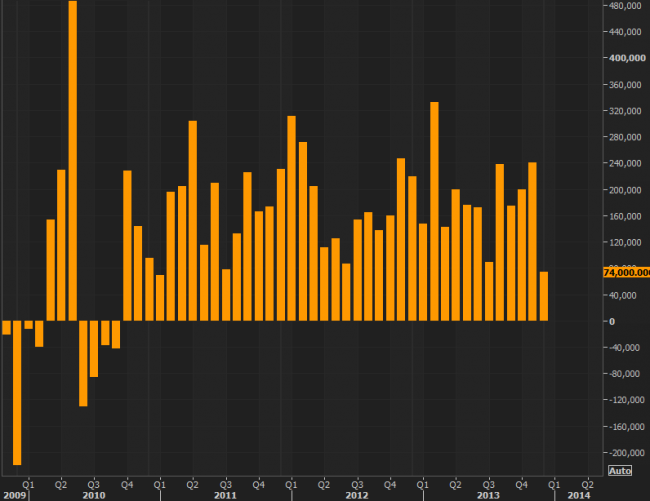

Headlines from the December non-farm payrolls report:

- Lowest reading since Jan 2011

- Prior reading was 203K (revised to 241K)

- Unemployment rate 6.7% vs 7.0% expected

- Prior unemployment rate was 7.0%

- Private payrolls 87K vs 200K expected

- Manufacturing payrolls 9K vs 15K exp

- Average weekly hours 34.4 vs 34.5 exp

- Underemployment rate 13.1% vs 13.2% prior (revised to 13.1%)

- Participation rate 62.8%

- Prior labor force participation rate was 63.0%

USDJPY ran stops ahead of the release on the upside but has been slammed down to 104.40. The US dollar is getting beaten up all over the place, except for the Canadian dollar, which is taking the mother of all beatings.

Non farm payrolls net change

On the release, the main headline is a big miss and that’s what matters now but the unemployment rate is important and it tells you why most Fed members don’t like to target it. The fall in the unemployment rate was almost entirely due to a drop in participation, which is far from good news. There are some good signs in the report like the upward revision to Nov data but it’s mostly negative, including fewer average weekly hours.