The Australian Bureau of Statistics will be dusting off the PC keyboard today to prepare for the release of Australian CPI, which they generously provide once per quarter. Yep, while nearly everwhere else manages a CPI result once a month, every 3 months is all you get from the Australian Bureau of Statistics . So, enjoy it, the next one isn’t until April.

Prior to the CPI data is Westpac Consumer Confidence, due at 2330GMT:

- Westpac Consumer Confidence (s.a.) for January m/m, prior was -4.8% to 105

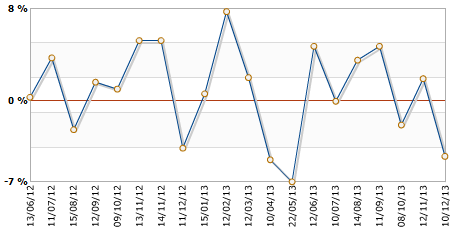

Westpac consumer sentiment to be released on 22 January 2014, graph of past results

–

The main course follows at 0030GMT, Q4 CPI. I’ll be back with a closer look at market expectations, of implications of results one way or the other, and for implications for AUD trade in the post-release. For now, though, this is a quick preview.

Q4 CPI

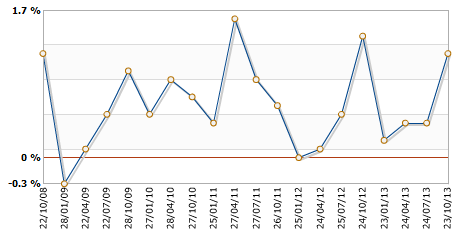

The ‘headline’ result is the q/q:

- expected is ++0.4%,

- prior was +1.2%

For the y/y,

- expected is 2.4%, prior 2.2%

Graph of the q/q change, past results:

–

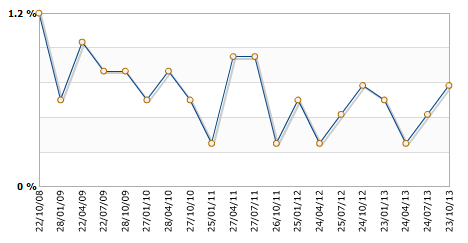

For the ‘trimmed mean’ (which is the measure the RBA pays most heed to): it is the ‘core’ inflation figure where the RBA target band is 2 -%.

For the q/q:

- expected 0.6%,

- prior 0.7% q/q

For the y/y:

- expected is 2.3%, prior 2.3%

Graph of the q/q change in the trimmed mean measure, past results:

–

Finally, there is the ‘weighted median’ CPI:

- For q/q: expected is 0.6%, prior was 0.6%

- For y/y: expected is 2.3%, prior was 2.3%