USD/CAD broke 1.10 today for the first time since August 2009 but the gains were mostly fleeting and the pair has retraced to 1.0977.

I know some long-term Canadian dollar bears who were waiting for 1.10 to take profit and with the Bank of Canada scheduled for tomorrow, they will square up rather than roll the dice with an unpredictable central bank. A second factor is oil flows. Around the 25th of each month, the bills are settled for Canadian oil exports and that could weigh on USD/CAD toward the end of the week.

The main reason to cut USD/CAD longs is that the Bank of Canada won’t shift to an explicit dovish bias tomorrow and that will knock USD/CAD down, at least temporarily. The OIS market is pricing in a 38% chance of a rate cut in the coming year but the fear is overdone.

The Bank of Canada statement has evolved rapidly in the past few months from hawkish to slightly dovish. In September and earlier, the BOC had a hiking bias:

Over time, as the normalization of these conditions unfolds, a gradual normalization of policy interest rates can also be expected, consistent with achieving the 2 per cent inflation target.

The shift to neutral in October was a surprise to most (but not us). They cited persistently-below target inflation for the shift:

Although the Bank considers the risks around its projected inflation path to be balanced, the fact that inflation has been persistently below target means that downside risks to inflation assume increasing importance. However, the Bank must also take into consideration the risk of exacerbating already-elevated household imbalances. Weighing these considerations, the Bank judges that the substantial monetary policy stimulus currently in place remains appropriate and therefore has decided to maintain the target for the overnight rate at 1 per cent.

In December, the BOC hinted at a dovish stance but maintained an overall neutral bias:

The risks associated with elevated household imbalances have not materially changed, while the downside risks to inflation appear to be greater. Overall, the balance of risks remains within the zone articulated in October. Weighing these considerations, the Bank judges that the substantial monetary policy stimulus currently in place remains appropriate and therefore has decided to maintain the target for the overnight rate at 1 per cent.

No one expect a rate cut tomorrow but many analysts are talking about the Bank of Canada adopting a dovish stance tomorrow, here’s what they’re missing.

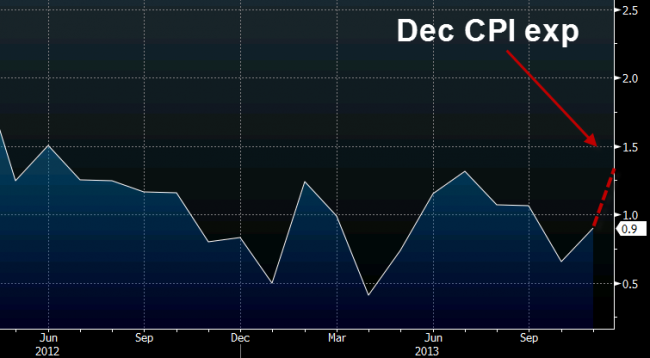

1) Inflation is picking up. The next report isn’t due until Friday but after falling to 0.7% y/y in October, the CPI rose to 0.9% in Nov and in Dec it’s expected at +1.3% y/y. The latest weakness in the loonie is a fresh reason to expect more inflation. In addition, the BOC has been consumed with the risks from rising house prices for years and the Teranet house price survey was up 3.8% y/y.

wec Canada CPI

2) US growth is picking up. In the first few months of Poloz’s term, his defining characteristic was optimism about US growth but in October, he finally threw in the towel, saying “The U.S. economy is softer than expected” in the October BOC statement. It turns out, he may have only erred on the timing because the latest forecasts from the IMF show revisions higher in US growth expectations. There is a lag as US growth flows across the border but it’s coming and that will comfort the BOC.

Anything less than a explicit hint at rate cuts will knock USD/CAD back to 1.0900 but if the statement remains remarkably similar, or even adds an upbeat note about US growth, look for a decline to 1.0850.