The headlines were earlier, here: The People’s Bank of China ordered commercial banks to halt cash transfers

and then further clarifications, here: More on the “The People’s Bank of China ordered commercial banks to halt cash transfers” headlines

Further now, direct from Citi in China:

- PBoC “system maintenance” is scheduled to occur over the holiday, speculates because banks are closed.

- Customers can still make transfers from now until end of working day on January 30 – right before the holiday begins.

In summary:

- According to Citibank China Customer Service, the bank is conducting a routine system upgrade over the first few days of the upcoming New Year bank holiday.

- System maintenance of this sort has occurred several times in the past.

The PBOC has not asked Citibank to stop customers from wiring funds. Customers can still log on to their account to put in fund transfer requests at any time. The receiving bank (non-Citibank) will process the funds to be transferred on the next business day, as it always does. Because of the Lunar New Year break, the next business day is Friday February 7. This is no different from the practice of banks throughout the world.

More here: No, There Is No Stoppage Of Cash Transfers In China

–

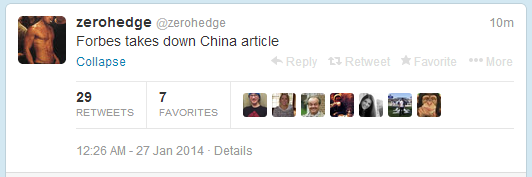

ADDED: Just to close this saga … As of 0527GMT Forbes has taken down the original article:

With a final word from MNI as of 0544GMT:

The suspension of foreign exchange transactions during the Chinese New Year holiday is “normal,” a State Administration of Foreign Exchange source told MNI. The source, who is not permitted to speak with the media, said that such transactions are typically suspended during the holiday. “Foreign exchange transactions are just suspended during the new year — it’s normal,” the source said. He was commenting following a news report referencing a Citibank announcement that foreign currency transactions won’t be accepted from 1800 local on Thursday until 0900 on Friday, February 7. The announcement followed heightened concern in about whether a possible trust product default will trigger an avalanche of failures in the Chinese financial system. Although traders in the interbank market are concerned about the liquidity outlook, they said Monday that the suspension of transactions during the holiday period is an annual occurrence and not out of the ordinary.