High Frequency Economics noted that historically poor weather hasn’t hurt the ISM manufacturing index and although survey Chairman Holcomb remained upbeat he conceded that weather couldn’t account for the entire slowdown.

So what’s your trade assuming that the US economy is much weaker than believed and 2014 growth is more like 1.8% than the 2.8% consensus.

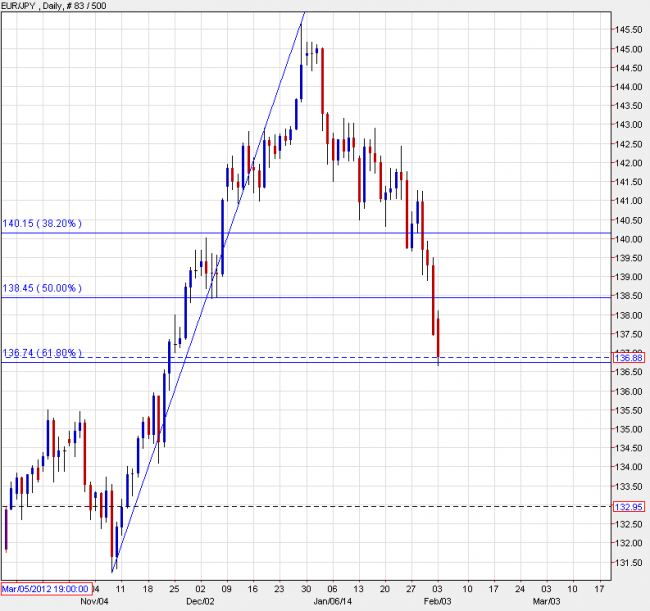

The yen crosses are obvious trouble spots.

My two ideas:

1) Short EUR/JPY. It just touched below the 61.8% retracement of the Nov-Dec rally and a softer US economy would surely push the ECB toward some radical moves sooner or later. A close below this level might be lights out but a bounce first is possible.

EURJPY daily

2) Buy gold. The gold bugs have been battered in the last 18 months but they’ll spring back to life on signs of economic trouble.