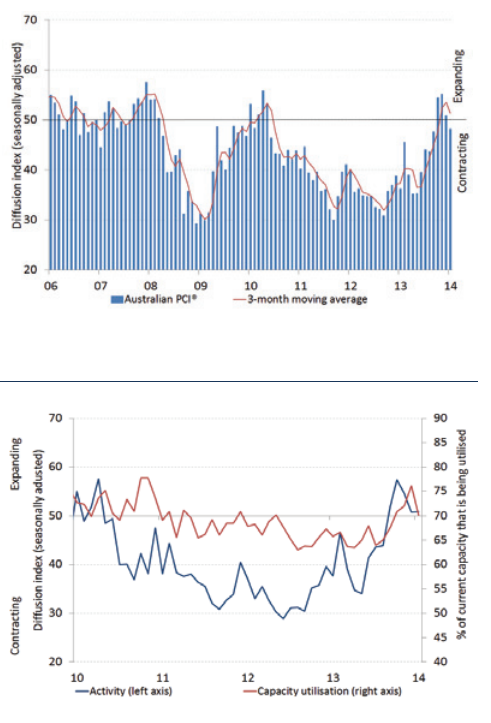

prior was 50.8 (earlier in the week we had the January manufacturing and services PMIs).

I was expecting it at 2230GMT – early now.

- Down 2.6 points from December

- Back in contraction after 3 months above 50

- renewed decline in new orders

- steeper fall in employment and a continued reduction in deliveries from suppliers

- “House building remained the strongest performing sector, although its expansion moderated to its slowest pace in the past five months

- Activity in both the apartment and commercial construction sectors declined after growth over the previous four and three months respectively.

- Engineering construction expanded, recovering from a contraction in activity at the end of 2013

- Respondents said that easing demand conditions, tight credit conditions and a lack of public sector tenders had largely contributed to the decline in new orders in January

- House builders pointed to customer enquiries and buyer confidence holding up reasonably well in January, despite some slowing in new orders

- Investor interest in the housing market was also said to have remained solid in the month”

-

OK, so that’s all three PMIs back into contraction territory now, construction had been the one bright spot in these surveys. Gonna weigh on the AUD – but the market is awaiting the 0030GMT release of the RBA’s quarterly Statement on Monetary Policy – preview here

—

Updated 0055GMT:

MNI have written up a comprehensive recap here: Australia Construction Index Slips Into Contraction In January