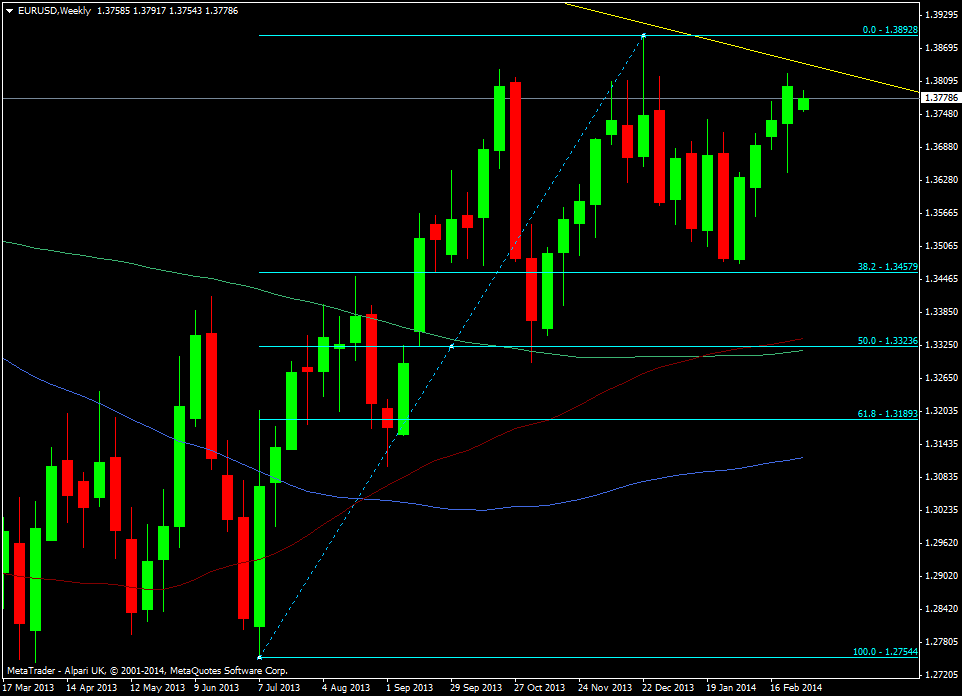

CA entered a short at 1.3780 back in December with a profit target of 1.33 and a stop at 1.4160.

Today they re-affirm their call by saying that despite the tick up in inflation the weakness in growth and jobs should keep the risk of inflation falling further intact. They don’t rule out the ECB acting this week with the possibility of them announcing the sterilisation of the SMP.

EUR/USD weekly chart

I’m still short from last week but I think it will be a push to see 1.33 anytime soon unless some real poo hits the fan. There are signs that the economy is picking up but as we’ve seen today it’s still a mixed picture and comes on the back of a very weak jobs market. If we do head lower I’m very interested in that confluence of the 50 fib and 55 & 200 wma’s in the 1.3315/40 area.