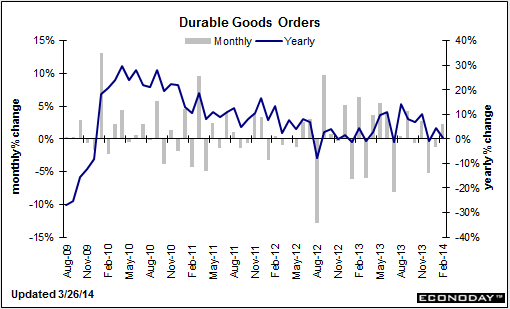

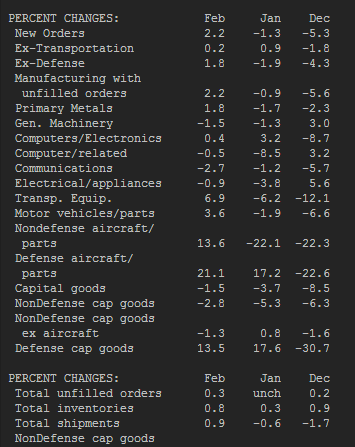

- Prior -1.0%. Revised to -1.3%

- Cap goods non def ex air -1.3% vs 0.5% exp. Prior 1.7%. Revised to 0.8%

- Ex transport 0.2% vs 0.3% exp. Prior 1.1%. Revised to 0.9%

- Ex defence +1.8% vs -1.7% prior. Revised to -1.9%

- Cap goods shipping non def ex air 0.5% vs 0.8% exp. Prior -0.8% revised to -1.4%

USD/JPY runs up to 102.47 initially on the headline number but it’s a very mixed bag beneath the numbers.

- Total unfilled orders rose 0.3% from 0.2%

- Total inventories 0.8% vs 0.3% prior

- Total shipments 0.9% vs -0.6% in Jan

The Capital goods component, often seen as an indicator of investment, took a big dive.

US durable goods breakdown 26 03 2014

USD/JPY quickly turned around the pop to fall to 102.34.

Just looking at the bigger sectors, in a dollar sense it’s not overly a bad report. The ex defence rise as well as manufacturing posted good gains as did transport equipment.