- Prior 53.3

- New business 53.9 vs 56.0 prior

- Outstanding business 48.3 vs 50.9 prior

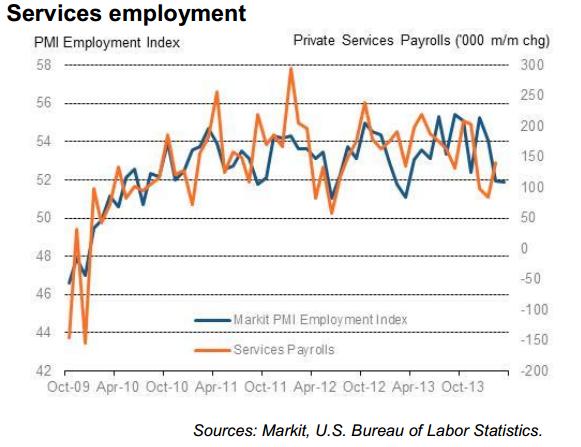

- Employment 51.9 unch

- Prices charged 53.5 vs 52.9 prior

- Input prices 54.4 vs 54.7

- Expectations 78.1 vs 73.4

Apols folks the cal had it down as final read but it’s the flash.

Jobs remain just above the magic 50 expansion mark but at a 12 month low. Another report showing greater expectations but against falling business currently.

The composite index came in at 55.8 vs 54.1 prior ,which covers the services and manufacturing PMI’s

Chris Williamson at Markit highlights some warnings on jobs and the economy on the report;

“Service sector activity rebounded in March after a weather-torn February, but the survey is clearly flashing some warning lights as to whether the economy has lost some underlying momentum and that growth could slow in the second quarter.

Even with the rebound, the two PMI surveys are merely consistent with annualised GDP growth of approximately 2.5% in the first quarter, largely unchanged on the disappointing 2.4% rate seen in the fourth quarter of last year.

Perhaps most the worrying signal is that new business showed the smallest monthly rise since late-2012. Job creation consequently remained stuck at the sluggish pace seen in February, which had been linked to the extreme weather. The flash manufacturing and services PMIs are together signalling private sector payroll growth of a mere 130,000 per month.”

US Markit services employment 26 03 2014