Morgan Stanley have entered into USD/CAD longs at 1.12 yesterday targeting 1.16 with a stop at 1.11 for a short term trade. They’ve also gone long an EUR/CAD at 1.5450 with a target of 1.62 and stop at 1.53.

They base the USD/CAD trade on that they see it as the best pair to track the rise in US yields and used the strong Canadian CPI numbers to scale in. They are looking for a break of 1.1280 to signal a push to 1.1465.

The trade is not off to the best of starts and they may be undone by their bearish fundamental view on Canada.

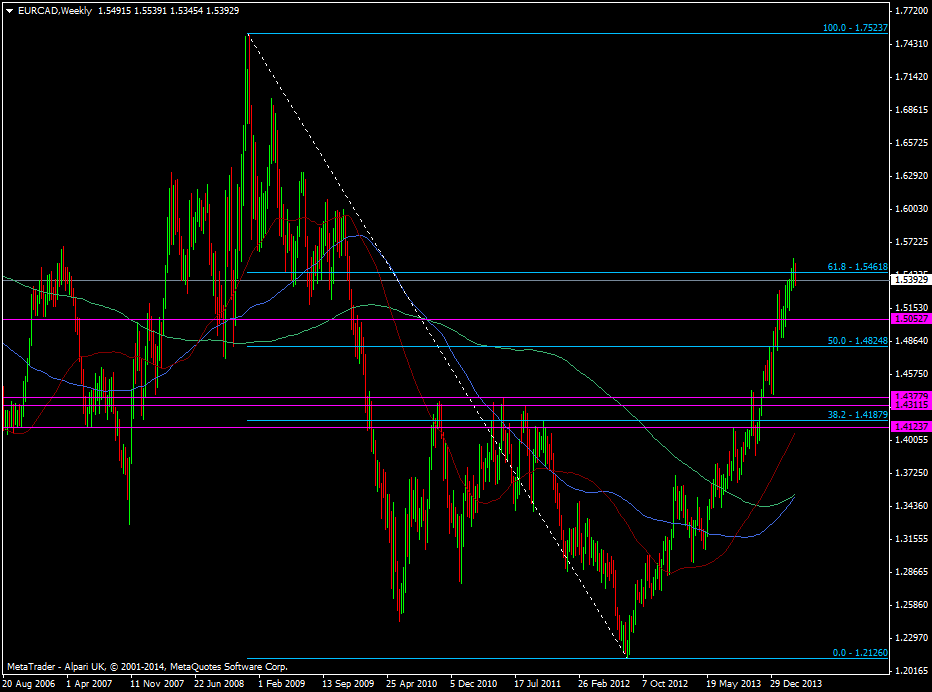

For EUR/CAD they see upside potential for the euro with the ECB standing still while sticking with their bearish view on Canada overall.

EUR/CAD has been on a tear since February last year so they’re buying into a the top of a very big move. The first major road block is the Oct/Nov/Dec 2009 highs around 1.6000

EUR/CAD weekly chart 26 03 2014

You can see the full thinking behind MS call here from EFX