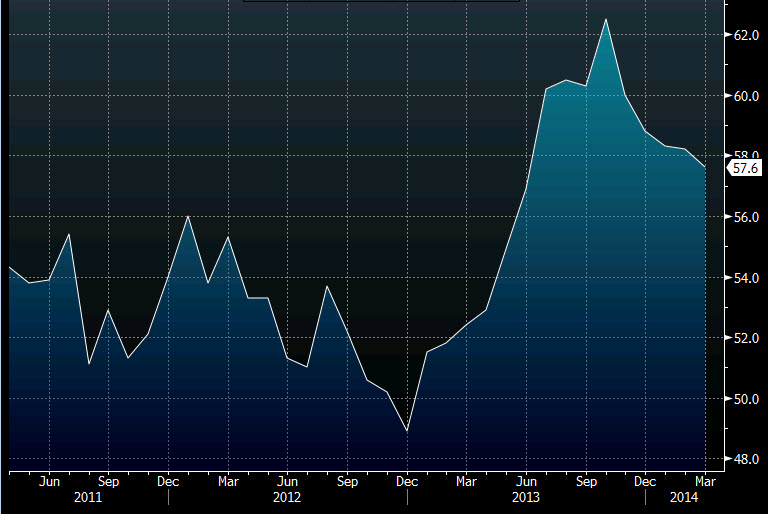

- Prior 58.2

- Composite PMI 58.1 vs 58.6 prior. Lowest since June

- Employment 53.5 vs 55.6

GBP/USD knocked down to 1.6605 which has been a bottom several times of late between here at 1.6595.

“While March saw growth slow across the services, manufacturing and construction sectors, all three continue to expand at very strong rates, meaning the economy looks to have grown by at least 0.7% again in the first quarter. With prices charged for services barely rising, and the exchange rate reducing the cost of imports, inflation is set to fall further in the coming months, extending this „Goldilocks‟ period of above-trend growth and falling inflation. Policymakers will be concerned that growth could ease further if sterling continues to appreciate, but there‟s no evidence to suggest that any slowdown will be anything other than modest, adding to indications that the UK is set to see growth outpace its peers in 2014.” Says Chris Williamson at Markit

UK Markit services PMI 03 04 2014

Our biggest slice of the economy has been falling from the highs since last October. It’s not a reason to get bearish on the pound just yet as we had a very steep run up over 2013. I would think that we start to level off but if we do continue to slide down towards 50 then we’re going to see the market question the recovery. If that continues along with lower inflation then rate rise expectations are going to be pushed further back also hurting Her Majesty’s quid.