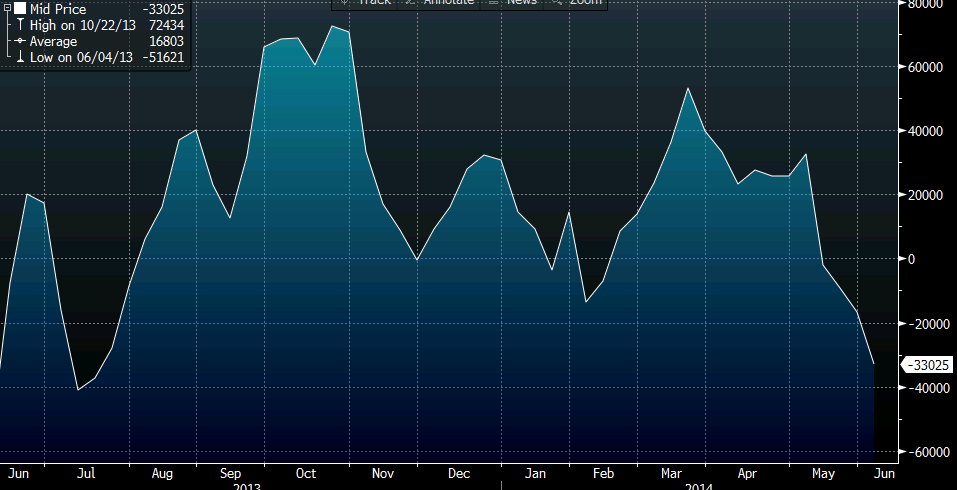

Forex futures market speculative positioning data from the CFTC Commitments of Traders report as of the close on Tuesday, June 3 2014:

- EUR net short 33K vs short 16K prior

- JPY net short 74K vs short 59K prior

- GBP net long 35K vs long 35K prior

- AUD net long 22K vs long 16K prior

- CAD net short 23K vs short 22K prior

- CHF net short 2K vs short 4K prior

- NZD net long 18K vs long 18K prior

Traders have been building short positions in the euro since the May ECB meeting and it was a scramble to the exits once EUR/USD hit 1.3503 yesterday. The market tried to push to move today but a squeeze up to 1.3677 didn’t gain any momentum and we’ve slid back to 1.3642.

I’d wager that the vast majority of those euro shorts are still in the money but not by much so it could go either way.

Not much else to report but the AUD and NZD carry looks a bit better every day.

Largest euro net short since July 2013