Last week Citi highlighted the “extreme shorts” in EUR/USD saying that currency managers continues to hold large shorts. This week they see signs of a squeeze coming.

While there are shorts aplenty still they note that leveraged accounts have cut their positions.

In two gauges that EFX look at they see oversold conditions that in the past have led to squeezes

Citi say the caveat for the leveraged guys taking their money off the table is that a lack of significant improvement in the economic fundamentals in Europe could see the hedgies and real money piling into more shorts.

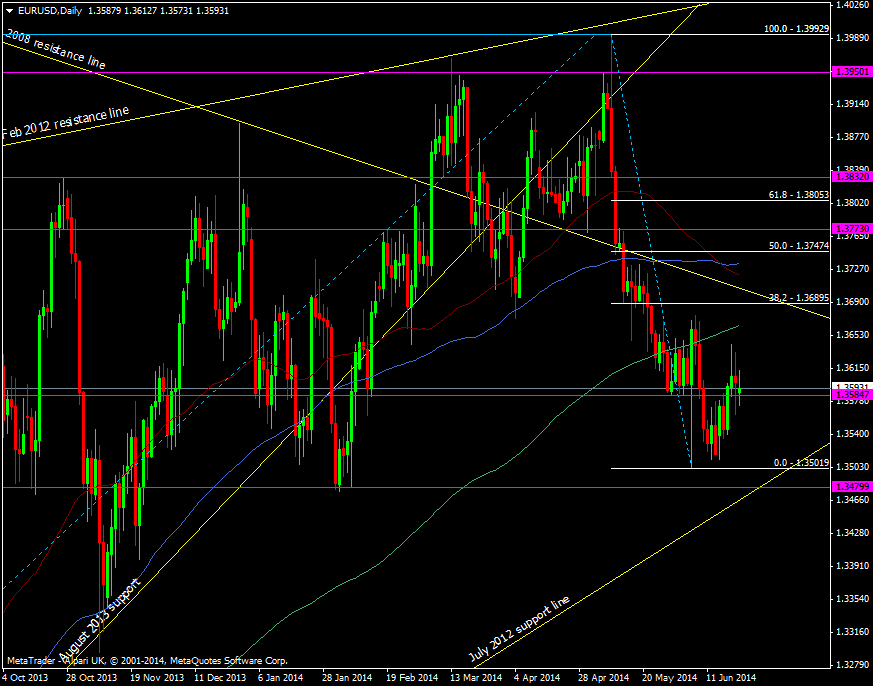

EUR/USD daily chart 23 06 2014

This mornings poor PMI figures make a strong case for shorts to add further but they may be near their limits.

We’re still in a fairly well balanced market in EUR/USD with the shorts protecting what they’ve got despite the bulls running 1.36 last week. It suggests that we’re going to need some hefty news or data to swing the balance one way or another.