The good old US of A releases its umpteenth Q1 GDP revisions today and some in the market are putting on the tin hat for a horrific figure.

SocGen are one and they say that the current -1.0% could be revised down as low as -2.4%. A nasty revision like that they say could prompt questions over whether the weather is to blame for such a crunch on growth.

The market is expecting a heavy downwards revision to -1.8% and-2.4% is the lowest estimate being made.

Here’s what the other big boys are looking for;

- Barclays -2.0%

- Citi -2.0%

- Commerzbank -1.5%

- Credit Suisse -2.0%

- Credit Agricole -2.0%

- Deutsche bank -1.5%

- Goldman Sachs -2.0%

- HSBC -1.9%

- JPM -1.7%

- Moody’s analytics -1.9%

- Morgan Stanley -2.1%

- UBS -2.0%

The market is gearing up for a big downward revision so the bigger risk is that we get a better than expected number which will boost the buck. It’s also a bit difficult to gauge the possible reaction in the dollar as these are just revisions and the market has seen improved data so far in Q2.

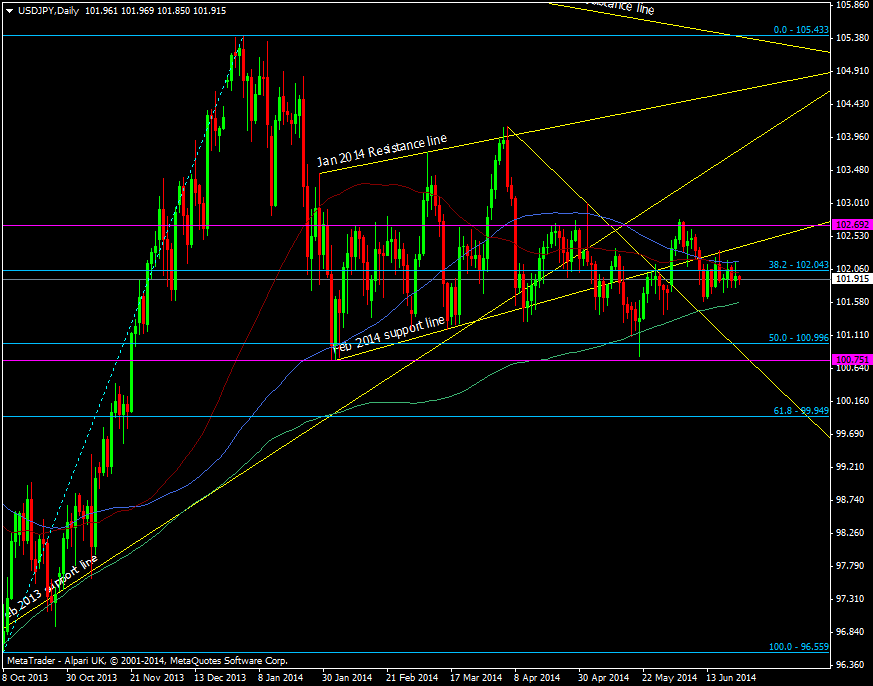

I wrote yesterday that I was looking for a good entry point to go long in USD/JPY and this release might give me that opportunity. In my view anything worse than -2.0% could see the dollar knee jerk lower and I’m going to be placing some buy orders in below to soak it up.

USD/JPY daily chart 25 06 2014

The first point will be a few pips off the 200 dma at 101.58 and then roughly 25 pip intervals down to 100, though I don’t expect to see it go that far.