I know not why we had a sharp move lower in gold but suspect that we’re seeing some bad love for the dollar in general.

What is surprising is that the move also comes as the VIX takes a bit of a jump to 12.40 from an 11.72 low. You’d think that any run up here would play into the safety aspect of gold. It’s been floating around the 10/12 mark recently and there’s nothing to suggest anything of note that should spook the market, but it’s worth keeping an eye on.

VIX 08 07 2014

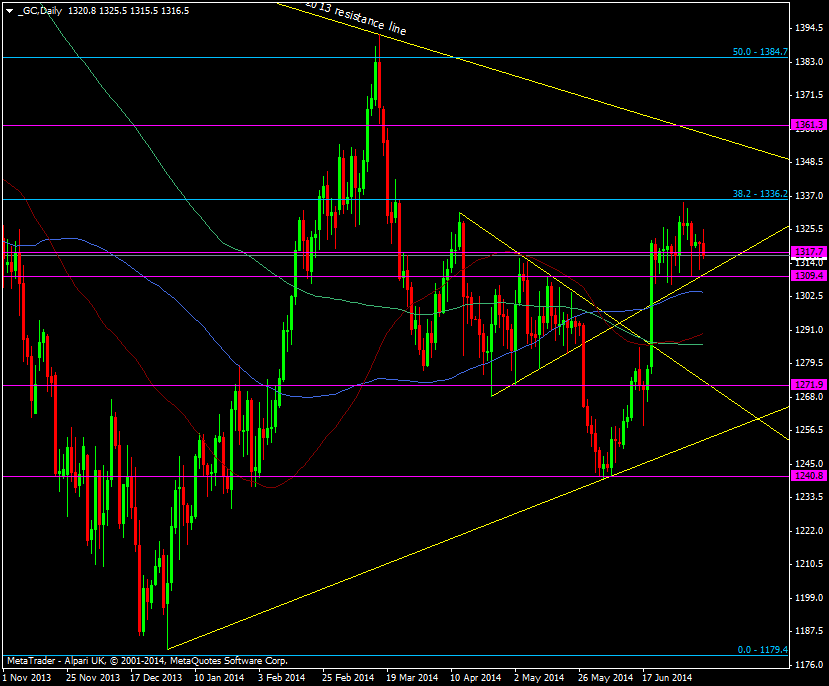

In the meantime gold continues to edge down from the 1334 highs and we could look to test the April support line and former resistance level at 1309/10. Just under that is the 100 dma at 1304

Gold daily chart 08 07 2014

There’s also a nice confluence of the 55 and 200 dma’s at 1286/89 should we have a look that far.

With gold bugs building up again we could also get another squeeze on longs. The COT data points out a heavily long market and we know what happened the last time they were.