Batten down the hatches, forget rate rises, watch out for more QE. It’s all gone horribly wrong!

Admittedly that’s a bit of a rough report for manufacturing, especially after the great PMI last week. The ONS had no explanation for the drop and it was seen across the whole sector, so there’s no finger pointing at the moment.

Eamonn had a warning from the British Chamber of Commerce last night that although manufacturing had been seeing some good growth it was still lagging behind the other industries. The important part of the story was that exports and investments weakened in Q2 and that’s not good news.

Our biggest trading partner, the mob across the channel, are still in a very soft situation so we’re finding it tough to sell goods over there. Other markets are being looked into but it’s a slow process.

As I feared at the start of the year, we need to see exports pick up as we’re getting to the point where the domestically led recovery could flatten out.

It’s not all doom and gloom but it is a worry. Manufacturing still only makes up a small part of GDP but it does make up for a lot of livelihoods.

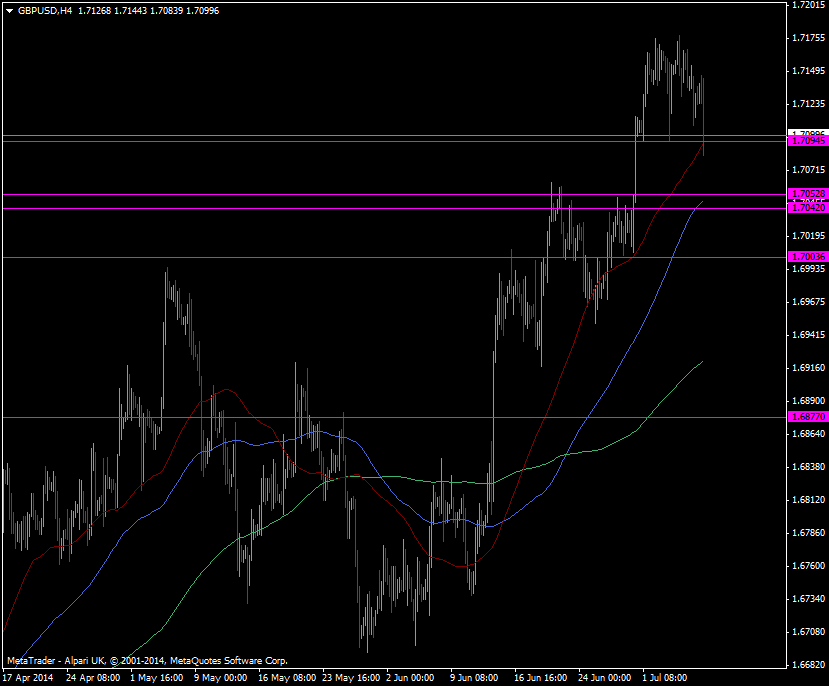

Cable took the obligatory battering down and fell through 1.7100 breaking support at 1.7090/95 and the 55 h4ma also. We’re back up into 1.7100 and we’ll get another idea of the strength of dip buying.

GBP/USD h4 chart 08 07 2014

If we hold 1.7100 here then I see us moving back up to 1.7130/40 but there might be some mild resistance at 1.7110. Failure to hold here and the 1.7080 level and we’ll be looking at a test of the 1.7050 area