I had a summary up from Goldman Sachs latest ‘The Global FX Analyst’ client note here.

Here’s a little more from the client note, this time detail on the GBP forecasts, with detailed reasoning:

British Pound FX Forecasts:

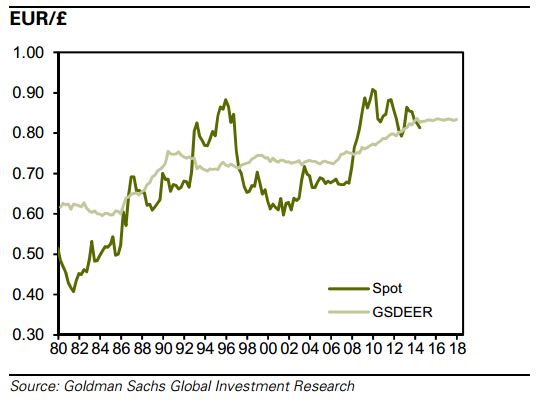

- We have recently revised our GBP/$ forecasts to 1.73, 1.74 and 1.73 in 3, 6 and 12 months from 1.68, 1.69 and 1.65 previously. This implies EUR/GBP at 0.78, 0.77 and 0.75 in 3, 6 and 12 months. Current GSDEER for EUR/GBP is 0.83 and for GBP/$ is 1.47.

- Motivation for Our FX View: Sterling has appreciated notably in recentmonths on the back of a substantial improvement in activity indicators and a hawkish shift in rhetoric from the BoE. The market now discounts a notable degree of monetary tightening. We expect further GBP strength as a function of relative growth differentials between the UK and the US and Euro area. This economic strength will likely support capital inflows, which would offset some of the external vulnerability linked to the relatively large current account deficit.

- Monetary Policy and FX Framework: The Bank of England is tasked with price stability, defined as CPI at 2% over time. In August last year the Central Bank introduced forward guidance, clarifying that it would not consider raising the Bank Rate until the unemployment rate reaches 7% (with an inflation ‘knockout’). In the February Inflation Report,the MPC announced a replacement to this existing guidance framework – with more emphasis on the outlook for inflation and spare capacity – once the unemployment threshold is reached. Sterling operates under an entirely free float, although the BoE occasionally comments on exchange rate developments.

- Growth/Inflation Outlook:GDP for 2014Q1 increased by 0.8%qoq. We have recently revised up our GDP forecasts and expect 3.4% in 2014, up from 3.0%, reflecting the persistent strength of UK activity indicators. While UK activity has been surprisingly strong in the past 15 months, inflation has been surprisingly weak. Following a further downside surprise to inflation in the May data, we lowered our annual CPI inflation forecast to +1.5% for 2014 from +1.7%.

- Monetary Policy Forecast: Reflecting the upward revisions to our growth forecasts and the recent ‘hawkish’ shift in the communication of a number of MPC members, we have brought forward our forecast for the first rise in Bank Rate from 2015Q3 to 2015Q1.

- Fiscal Policy Outlook:The government still plans to reduce the deficit gradually, albeit at a slower pace than initially projected. The deficit is expected to turn into surplus in 2017-18, mostly due to spending cuts.

- Balance of Payments Situation: We forecast a current account balance of -3.6% of GDP in 2014, currently tracking at -4.4%. Portfolio flows remain difficult to assess given the large cross-border flows linked to London as a financial centre. Things to Watch:The impact of the cyclical acceleration on capital inflows remains a key factor.

Also, this on EUR/GBP (GSDEER is a Goldman Sachs model)