A little something for the weekend (and there’ll be more to come … actually I should write “their’ll be more to come” or “they’re’ll be more to come” …. that should ignite the comments

)

Here’s the latest from Credit Suisse’s ‘FX Daily’, the summary and then a quick look at EUR/USD and USD/CHF.

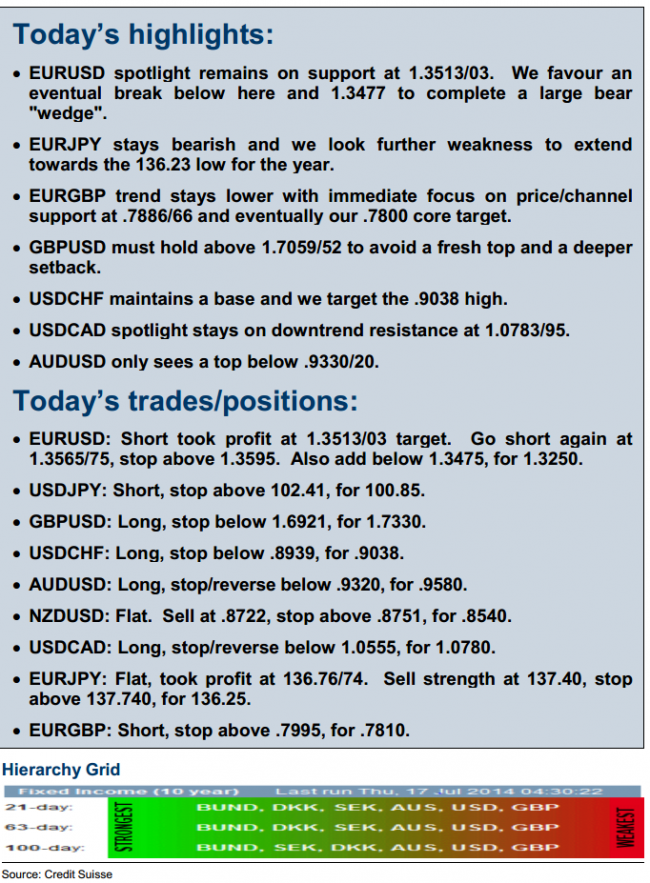

First, their daily summary:

On EUR/USD, they refer to the weekly chart (I posted it yesterday, here: Technical Analysis chart: EUR/USD moves closer to the edge … top may nearly be at hand)

- Resistance 1.3541, 1.3570/73*, 1.3587, 1.3611*, 1.3628*, 1.3641*, 1.3652/53*, 1.3665/66*, 1.3670/77*

- Support 1.3513/03**, 1.3483/77**, 1.3462, 1.3444, 1.3399*, 1.3374*, 1.3344, 1.3318, 1.3295**

- Resistance/Support tables rank level importance by stars *,**, to *** being most important

- The spotlight remains on support at 1.3513/03. We favour an eventual break below here and 1.3477 to complete a large bear “wedge”.

- Strategy: Short took profit at 1.3513/03 target. Go short again at 1.3565/75, stop above 1.3595. Also add below 1.3475, for 1.3250.

And, here’s a look at USD/CHF: