Yeah, baby! Get a load of that headline: FX Compass: Gearing for higher volatility

Its from a research note from Credit Suisse.

The bad news is, its pretty much downhill from the headline … (my, ever more disappointed thoughts, in italics):

FX Compass: Gearing for higher volatility (Yeah!)

- Implied volatility may be set for a modest rise, in our view (Oh, OK, well modest better than nothin’)

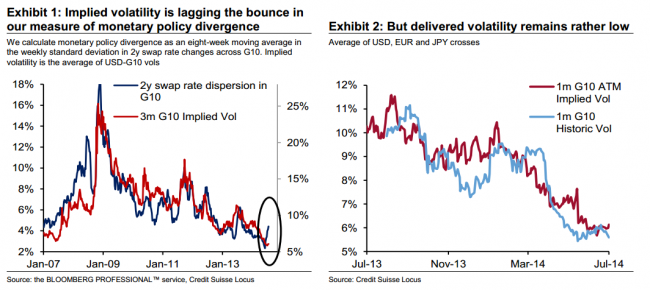

- Our preferred measure for monetary policy divergence in G10 has bounced. Over the recent few years a spike in policy divergence has correlated well with implied vols.(Yeah!)

- While this is, in our view, a constructive sign, we remain fairly cautious that our measure is a backward-looking indicator and that a more convincing divergence in data and policy may be needed to truly shock FX volatility (Oh, so … maybe not, right?)

- As such we prefer to focus on the potential for volatility curves to flatten (Flatten? Ah, **** this)

- This represents a cautious expression for front-end volatility to rise without going outright long and still exploiting the positive roll-down the curves entail (Its too late, don’t try to sweet talk me now)

- On this front, we note that EURJPY, AUDJPY and USDJPY appear to offer the highest outright entry points. EURCAD, EURUSD (and USDCHF as a proxy), on the other hand, exhibit the most stretched levels on the percentile rank historical comparison.

- We look for a flattening in EURJPY implied volatility term structure. Specifically, we recommend selling 9m in 3m EURJPY FVA.