Adam’s just put up the analysis of USD/CAD and I just want to add my two maple syrup pancakes worth to the mix.

We’ve been noting the rise in Canadian inflation recently and while the BOC has been calling it temporary, I’m not so sure. Aligned with some decent tech resistance around and above 1.0800 I liked the area for scaling in some shorts purely on the inflation picture as it could spur the Canadians into interest rate action faster than the Fed.

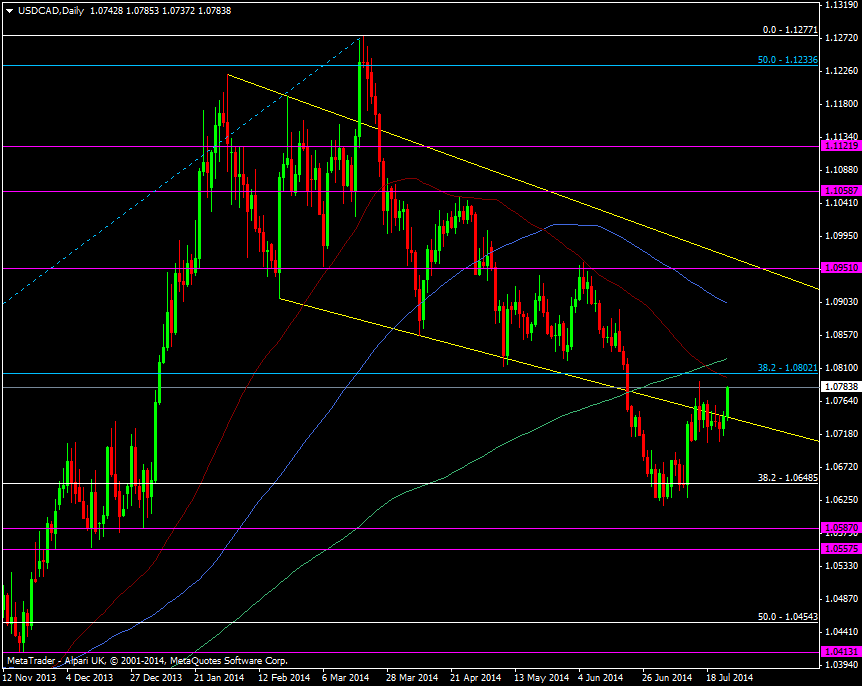

USD/CAD Daily chart 25 07 2014

That still may be the case but I’m more cautious that we’re starting to see some broad dollar strength coming in and it’s stoking some fear that we could be at the start of a bigger USD move, one we’ve been waiting on for a while.

Adam has set out his 5 main reasons why the short side may not be the best side of the street to be on and followed up with a further comment when chatting to him.

“The US dollar looks like it could really bust out. Yellen just needs to fire the starting pistol”

He then went on with his usual weekly tearful tirade about how the UK has nicked Canada’s best central banker ever, and how he misses him so much, and blah blah blah, but I won’t bore you with that

So as far as the trade idea goes, it’s on the back burner as the fundamentals of the States and therefore the USD will trump anything that happens in little old Canada for a while. We’ve been looking for USD strength over the last few months and it hasn’t really come despite the US economy actually showing some signs that it’s doing better. If we get a hint of action on rates from the Fed then we will rip higher in an instant but continued better data and the market will make that decision itself.

So from trading a fundamental view we must always look at both sides of the picture in any particular pair before hitting the button.