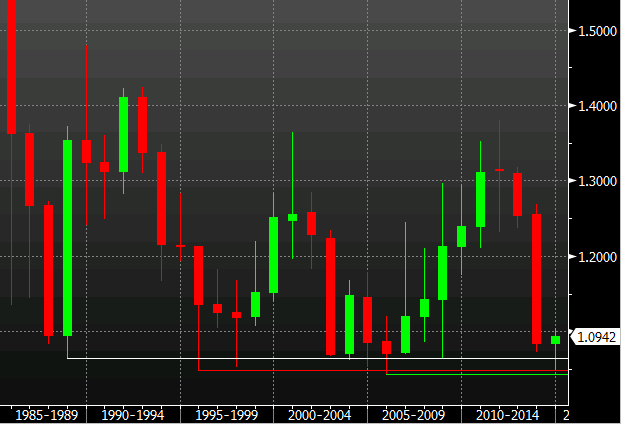

In relative terms the cross is still bouncing along the bottom of some very long term lows.

AUD/NZD yearly 01 08 2014

A technical picture doesn’t get much more hornier than that which is why I bought in against those lows earlier on this year. The trade has stayed in the money in the main but I’m still awaiting the big breakout.

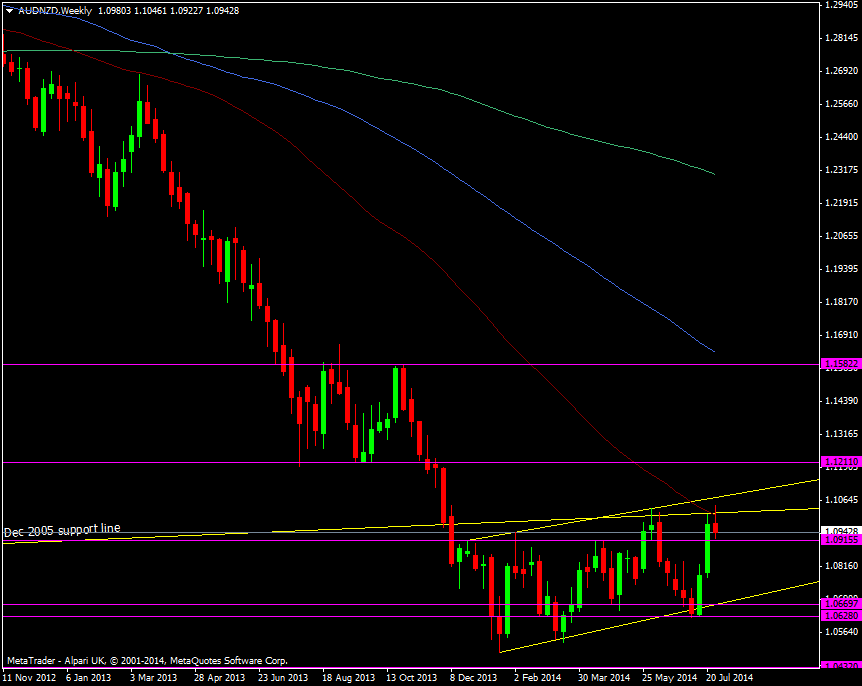

Scaling in a bit closer we have been in a shallow uptrend in 2014 and have been held up by the Dec 2005 former support line and the 2014 channel top. The 55 wma has also conspired to contain the break up.

AUD/NZD Weekly chart 01 08 2014

With the RBNZ maybe moving to the sidelines on rates and talking about the high level of the currency there is plenty in favour of the cross moving up. Obviously the other side of the trade is where the problem lies. Australia is coming of its resource boom and with global growth still fairly lethargic it’s had a marked effect on the economy.

The cross is much like EUR/GBP. New Zealand is the UK and Australia is Europe and the picture can be comparable, somewhat. If the aussies find their economy doing better then they will trump the kiwi’s and the trade has some legs. In the meantime it’s a waiting game but the levels down here are worth paying attention to.

The main fly in the ointment is the current carry on the trade, which doesn’t favour longs. It’s not a killer but it’s a slow drainer.

I still feel there’s great value in longs, even at these levels and particularly if we can break through this resistance. If you’ve got the patience to sit on a trade for a while then this could have some awesome returns. If we do fail again up here then I might take profit to negate the carry and hope that we drop back to a decent level to reload. If not I’ll be watching to catch the break up through the tech.

What I’m hoping for in AUD/NZD