Let’s get the BOE out the way first. Another non-event is on the cards. No change and no statement is expected. MPC meetings have become redundant news wise. It’s the minutes on the 20th August that will have the focus. Will we see a change in votes? Who and how many? Answers on a postcard please.

To say that recent European data has been uninspiring is probably an understatement and with the latest numbers this week, especially from Europe’s growth motor Germany, there may be a risk that the ECB get pushed into fresh action ahead of the TLTRO’s later in the year.

The deterioration in all but a few data points is going to test the ECB’s patience and they may bot be able to hang out until later in the year before acting again. While the new long term refinancing operations will be another liquidity boost it’s still going to be several months before we see any reaction to them. In the meantime we could have crossed the deflation line and the data could be even worse.

Rates may be at the “lower bound” but that doesn’t mean they are at the bottom. The ECB may be unwilling to go to zero on rates as psychologically it marks the point where they are virtually out of options, but unless they wish to announce QE and start printing 2 minutes after the presser then that’s the path of least resistance.

The time for talk is done. The way Europe’s wheels turn on policy is very slow so even an announcement of QE will take many more months to come to fruition and then to have an impact. By then it may be too late. Yes, news of it may kick the euro lower but at the moment the currency is the least of Europe’s problems. As I’ve said many times, the time to worry about the currency is when you’ve got orders going out the door and those prices are being affected by FX. If you’ve got no orders the level of the currency matters not.

So what will we get from Draghi & Co with inflation at 0.4% and a slowing German economy? I think there’s a pretty high possibility that they do cut rates again but otherwise it’s going to be all chatter and that might not be enough to get the economy through to the TLTRO’s.

Mr Draghi is very good at steering the market how he wants but despite all his fantastic powers he can’t magic growth in France or Italy in the next 2 or 3 months and the longer they leave it the cheaper the talk will get.

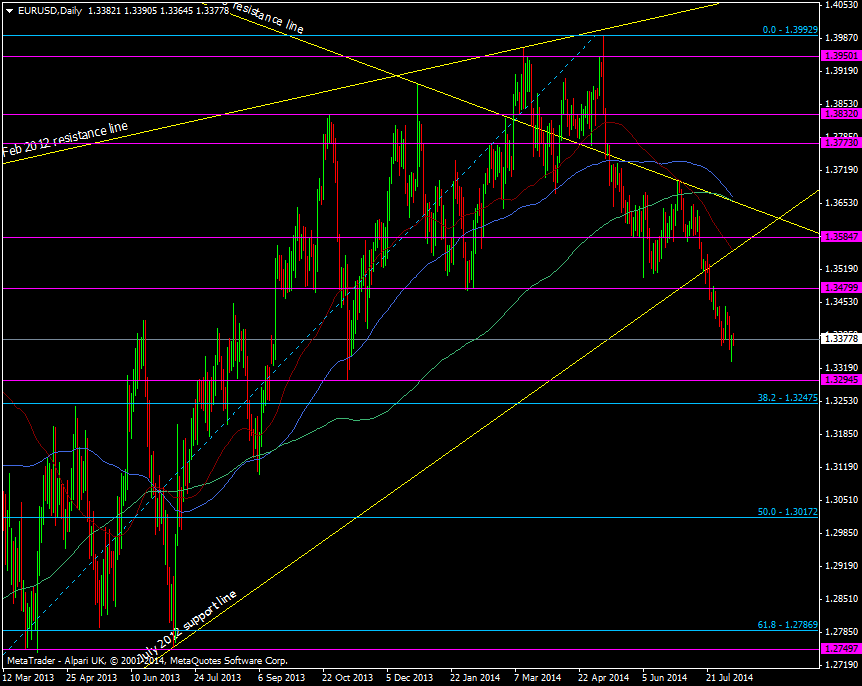

Whatever happens we need to be aware of the levels to watch in the euro.

On the upside 1.3440/45 is the closest half decent level to watch ahead of 1.3480 and a look at 1.3500

Below we still have the 55 mma at 1.3370 and 100 wma at 1.3356, which is not allowing the price to close below it, not for the want of trying. Further down is support at 1.3295/300 followed by the 2012/2014 38.2 fib at 1.3248

EUR/USD Daily chart 07 08 2014

One thing we can probably be sure of and that is that the sellers are well in control and any sizeable upside moves are likely to be met with some heavy selling. If Draghi doesn’t spark the euro lower then that my be a good opportunity to load up or add to some shorts.

What do you think is on the cards for the ECB today, Rate cuts, QE, or just more talk? Let us know in the comments.