Both Brent and WTI are getting hammered at the moment as plentiful supply and a lack of growth in Europe puts the dampeners on demand.

Brent has been down over $2 and WTI is down around the same.

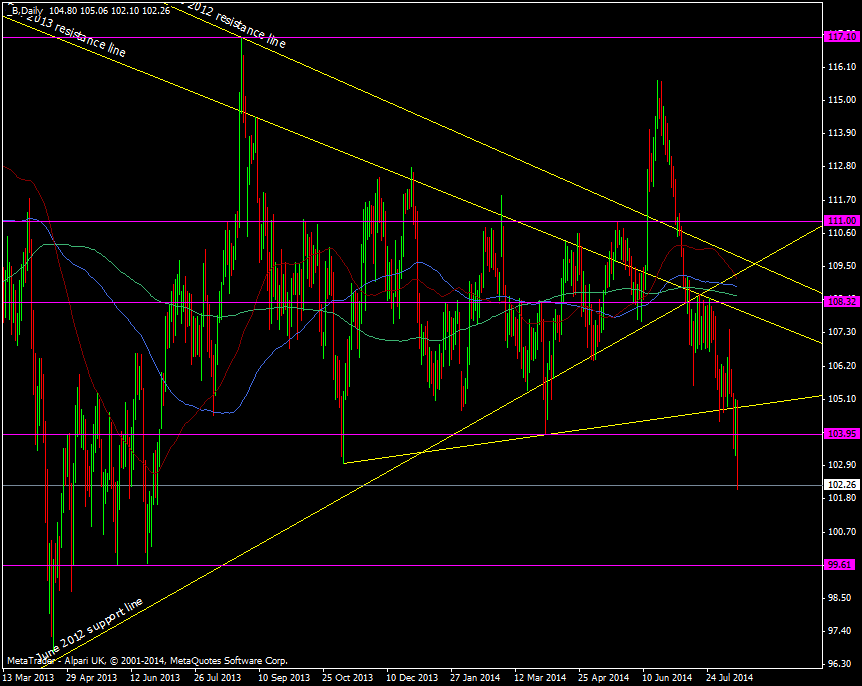

The $100 mark is always a big number for Brent as it represents a crunch point for production margins.

Brent has broken down through the November 2013 lows. There’s limited support at 101.50 before we get to 100 and then support at 99.50/60

Brent crude oil 14 08 2014

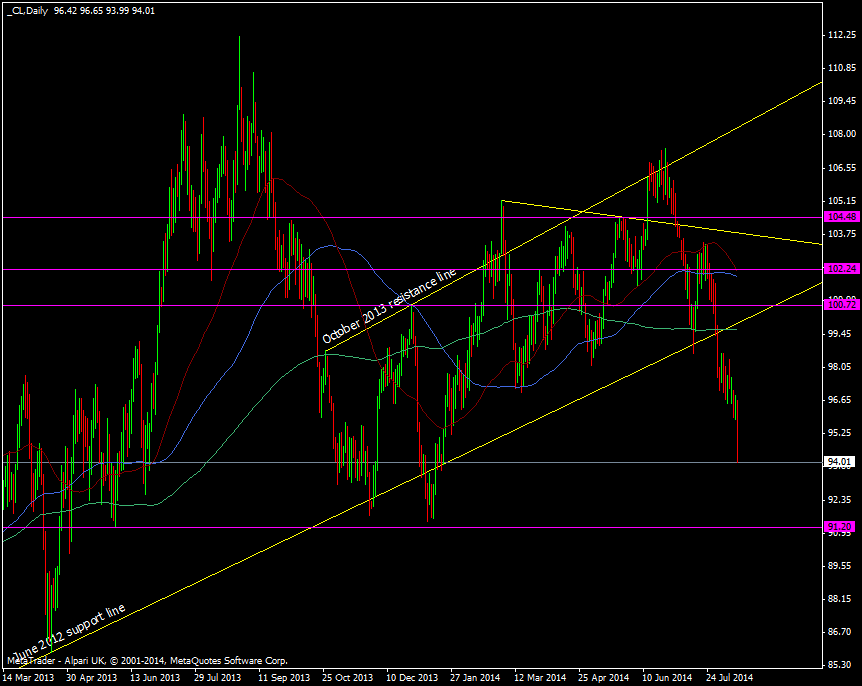

WTI is looking like it hasn’t got a parachute and the next level of mild support is around 93.60 then 91.70, 91.40 and then 91.20

WTI crude daily 14 08 2014

The growth/demand issue is hitting across most commodities, particularly metals as there are sizeable losses for copper, ali and Iron ore, to name but a few.

Economically it’s not overly bad news to see commodity prices lower as that will make input costs cheaper and can be a boost to producers. For Europe it could drive headline inflation lower so the core number will be the more important number to watch on the next release.