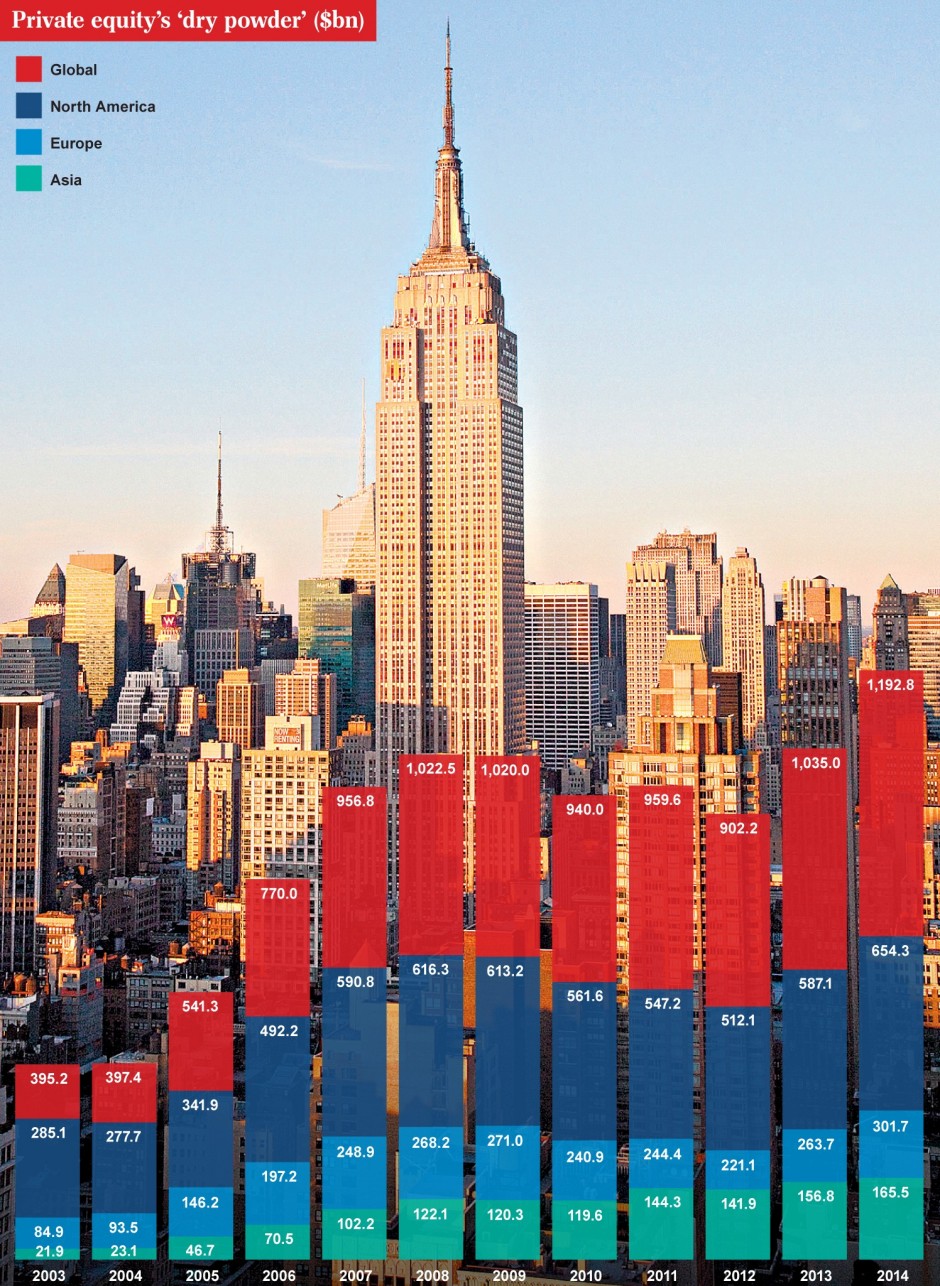

The Telegraph had an interesting article out yesterday evening where they say that some of the worlds biggest companies are sitting on $7tn of cash piles. With private equity at the highest it’s been since 2003 the question is when will companies start spending it?

Show me the money

We’ve long been pimping that if companies start spending then we could see economies rejuvenated but there is still some trepidation from businesses. This is also a big part of why we are seeing low credit demand as companies don’t need it. Firms have cut costs, reduced debt and made themselves leaner, which is what they should have done over the crisis. It now leaves them in a better shape in which to grow.

With one of the biggest markets (Europe) still in the doldrums firms still don’t want to commit while Europe remains weak and other major economies are still struggling to find their feet. The consumer is still not spending and sentiment in main street in general is still a big issue. It’s all a big chain reaction event and it needs the ball to start rolling somewhere.

The Telegraph is a little more upbeat that the spending spree is imminent but I’m not so sure. When it does we should see sparks fly. If it doesn’t then we’re going to see this flatlining growth continue for a long time.