The market is underestimating the importance of RBA Governor Glenn Stevens semi-annual appearance at the House of Representatives today.

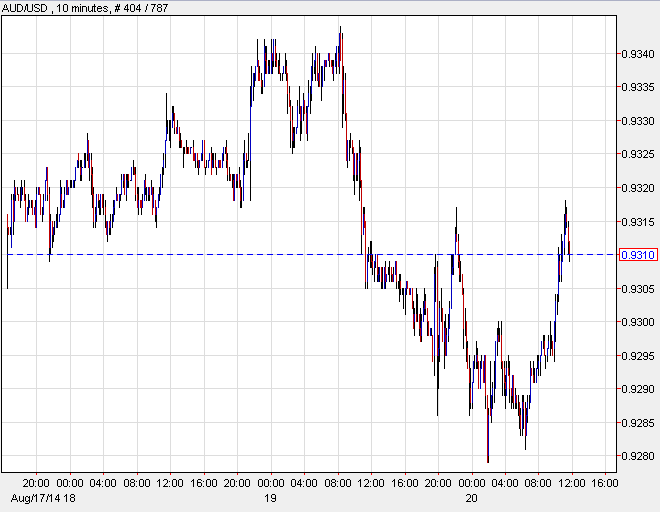

The Australian dollar has been choppy today but the latest move was to a session high at 0.9318.

AUDUSD two day chart

I think the market is focused on the wrong things. Bloomberg has Five Takeaways From RBA Governor Glenn Stevens’s Testimony but they miss the headline that grabbed my attention. Here’s what was important: He virtually ruled out cutting rates.

“I’ve allowed the horse to come to the water of cheap funding, but I can’t make it drink,” the governor said.

“I don’t think interest rates are the answer at the moment,” he said, under questioning from MPs about what could be done to curb rising unemployment.

“The thing that is most needed now is something monetary policy can’t directly cause: more of the sort of ‘animal spirits’ needed to support an expansion of the stock of existing assets (outside the mining sector), not just a repricing of existing assets,” Mr Stevens said.

Translation: Something needs to be done but we won’t be the ones to do it. He tried to balance that with the regular jawboning on the Australian dollar but he also ruled out intervention around these levels and that means AUD/USD could easily get back to the 0.9750 zone without any particular fear of the RBA.

The overall tone at the moment is US dollar strength but the Australian dollar has weathered it well and that’s a positive. As risk appetite continues to improve, money will flow back into carry trades and benefit the Aussie.