I’ve finally taken my long held euro longs round the back of the barn and put them out of their misery on this break through 1.3300, so as is normally the case when you get stopped out, it’s likely to be the bottom before we see a 500 pip rip higher. Fill your boots folks

In all seriousness, the dollar is starting to behave how we’ve been expecting it too for sometime. Both Adam and I have pondered why the buck hasn’t been joining in the improving economic picture. Yes, there are still plenty of issues with the economy, and we’re quick to highlight them, but overall the US is in a better place than it has been over the last few years and that should have been reflected in the dollar a bit more we feel.

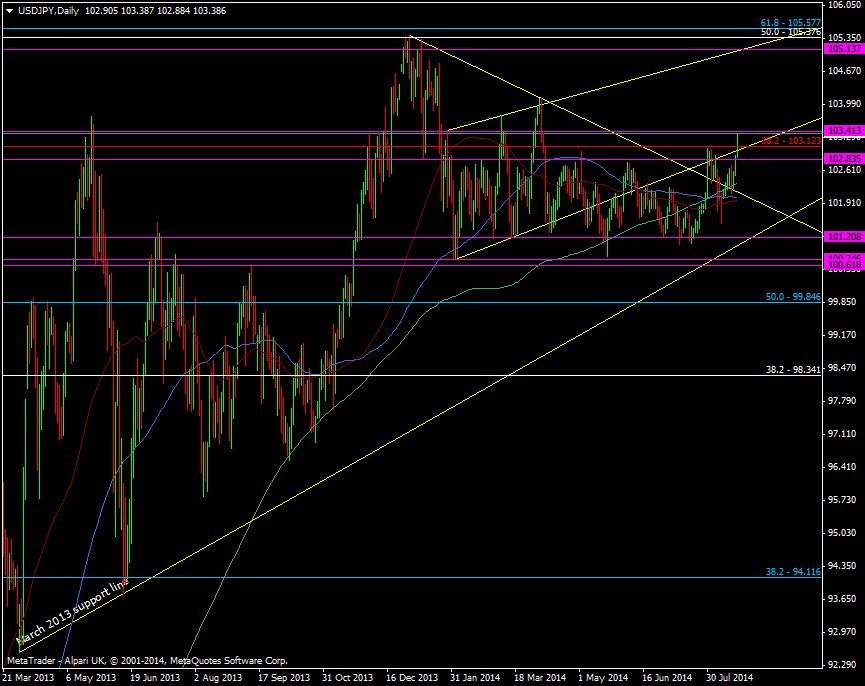

There looks to be some sort of response now though and the break through 103 has been defining. Finally we may see us break out of the 2014 range but there are still some levels that will keep buyers cautious abut this being another false dawn.

There’s resistance here at 103.40 but it’s mild and we’re going to need to see the years highs at 103.75 and 104.10 taken out before we can really believe we’ve got a decent rally on our hands.

USD/JPY Daily chart 20 08 2014

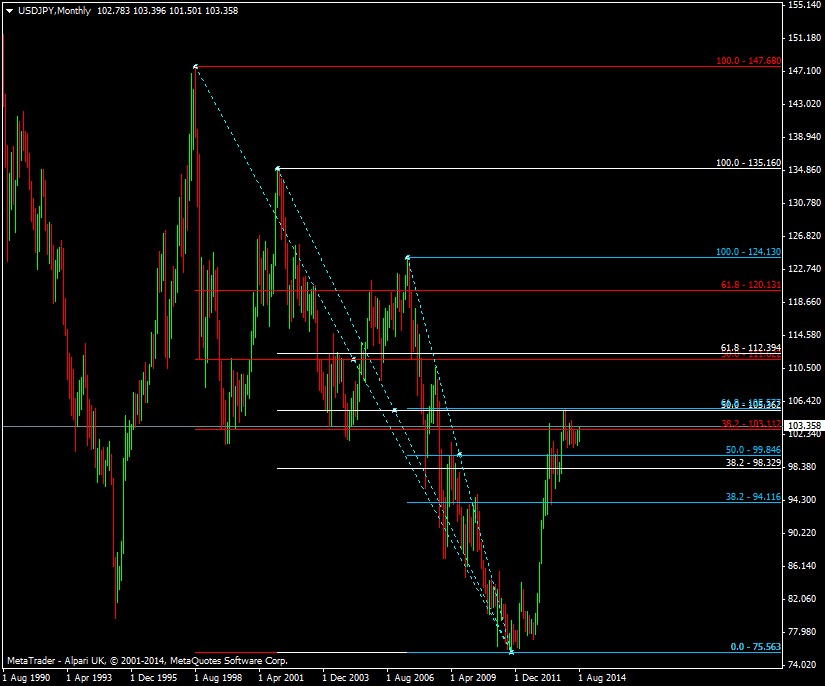

Looking at the wider picture we are still facing a big obstacle from some long term fibs.

USD/JPY Monthly chart 20 08 2014

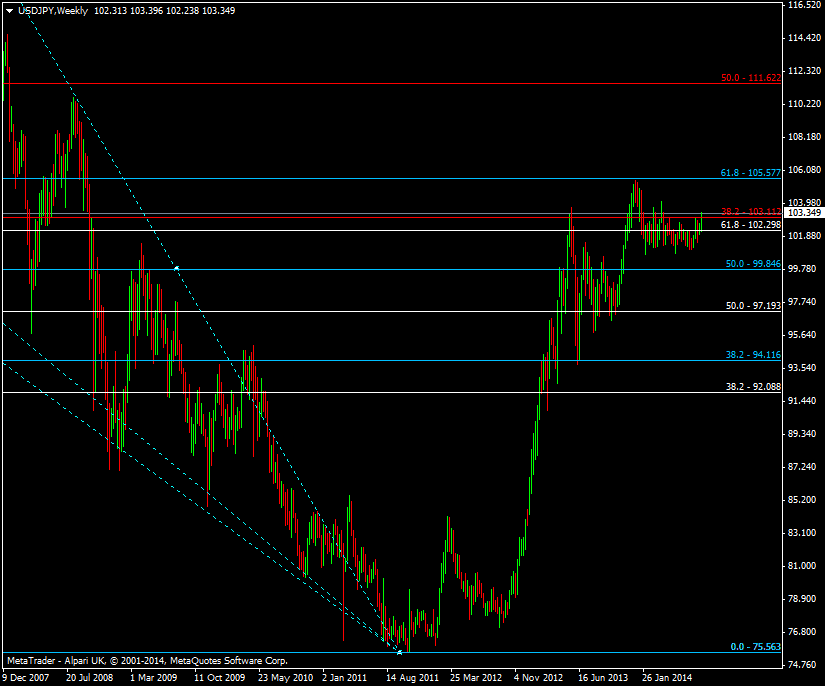

Bringing that in a bit closer we can see that the 105.60 level is a big level to watch but given the history of these big levels holding over the last two years the haven’t help up to a second attempt. Once we’re clear of that blue 31.8 fib then we’ve got a fair bit of open water until the next one.

USD/JPY Monthly chart 20 08 2014

I want to see the dollar really break out as confirmation of this current move or we face falling back into the usual range. Over the last year or so I’ve laid my trades on the line and where they are against the dollar I have always shown the consideration that the USD must be observed. It matters not what the RBA, RBNZ or it’s central bankers say or do, It matters not the state of the European and UK economies because as far as trading the buck goes, when it really moves it trumps all.

This may or may not be a fake out but it’s something I’ve been expecting for a while so there’s a chance it could be real. If it is then I’m cashing in my aussie longs and I’ll be looking to add to my USD/JPY longs in a big way.

If the dollar does move up then at some point it will reach a new comfortability level and range and that will be the time to think about buying other currencies. Until then be careful with trying to pick bottoms against the dollar for a longer term trade.

It’s all still early days but let the price do the talking.