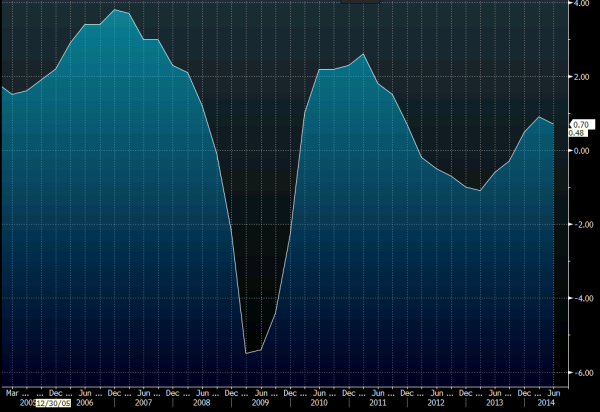

A look at the annualised GDP numbers seems to suggest it is.

Euro zone annualised GDP q/q 20 08 2014

Trevor Greetham from Fidelity Worldwide investments pens an article for the FT suggesting that Draghi’s magic spells to contain the crisis are wearing thin and that maybe it’s time to look at the crisis strategy playbook that has been pushed to the bottom of the draw.

He says that the ECB has fired it’s last shot on interest rates, that other policies will fail to filter through to the economy and so it’s time to abandon balanced budgets and go for growth.

The most dire warning is that he sees the crisis coming and going several times in the future.

Is Europe going to slip back into a major crisis and will we be talking about another collapse of the European project or will they still find their feet?

Part of the basis for my long Euro strat was based on the fact that both the US and UK, and to a certain extent Japan, had managed to claw themselves away from the crisis in some form and that would aid Europe’s recovery. Maybe the the multi country system is incapable of doing that when they all have to think on their own feet rather than just let the strongest carry them. More fool me for believing they could

The article is gated but open to a free sign up, or you can go snooping around google