A no-nonsense preview of non-farm payrolls for September 5, 2014 that sticks to the numbers:

Release time is Friday at 8:30 am ET (1230 GMT):

- Median estimate 230K (215K private)

- July reading: 288K (best since April)

- High est 300K (Landesbank)

- Low est 190K (First Trust)

- Avg of estimates made after ADP/ISM-non: 224K

- Standard deviation: 21K

- NFP 6-month avg 244K

- Unemployment rate est. at 6.1% vs 6.2% prior

- Prior participation rate 62.9%

- ADP 204K vs 212K prior (220K exp)

- ISM August manufacturing employment 57.1 vs 56.0 prior (highest since 2006)

- ISM August non-manufacturing employment: 58.1 vs 58.2 prior

- Consumer Confidence jobs-hard-to-get: 30.6 vs 30.9 prior

- Initial jobless claims 4-wk moving avg: 300K vs 299K at the time of the July jobs report

- Conference Board Help Wanted OnLine showed demand for jobs up 164.4K

- Aug Challenger job cuts: -20.7% y/y

- June JOLTS job openings: 4671K vs 4635K prior

The final two pieces of the puzzle were Thursday’s ADP data and the ISM non-manufacturing employment component but they pointed in opposite directions. The past 6 months of +200K payroll growth is one of the stronger periods on record.

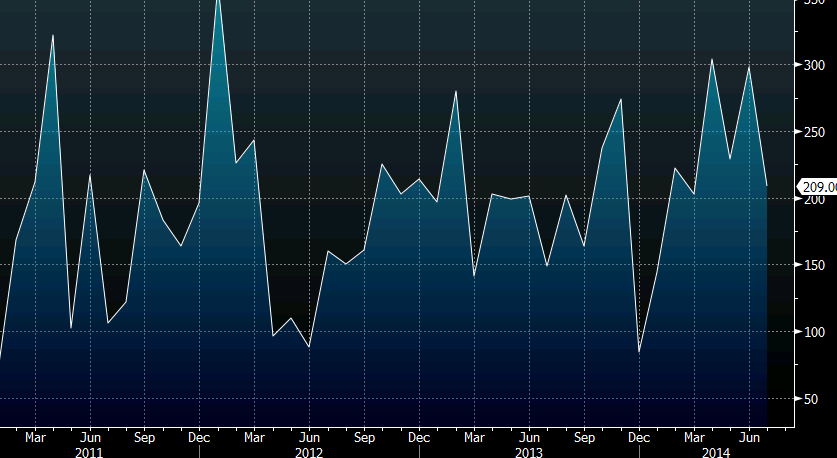

Non farm payrolls historical chart 2010-Sept 2014

Ultimately, the past two months of economic data has been stronger than any period since the crisis and a soft non-farm payrolls report would change nothing except to provide a dip for US dollar buyers. If the data is strong, it will almost certainly cause the Fed to shift rhetoric and hint at sooner rate hikes — something that appears more overdue each day.