A look at what HSBC and Deutsche Bank are expecting on the Swiss franc and from the Swiss National Bank (meeting coming up on September 18)

… hmmm … OK, this could turn into quite a long post …

Let’s start with HSBC:

Comment from HSBC (bold is mine):

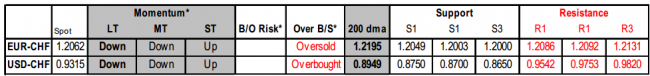

- EUR-CHF has dropped back close to levels that will likely have the SNB ready to act

- The persistent strength of the CHF against the retreating EUR means the floor is back in focus

- Looking back to 2012 when the SNB was active in the market and accumulating foreign exchange reserves rapidly, the daily lows in EUR-CHF were generally tracking just below 1.2050. There is no reason to assume the appetite for intervention is diminished at this point. In fact, the pressure for action has intensified lately, following renewed signs of economic weakness in Switzerland. GDP growth during Q2 14 was zero, far short of expectations for a 0.5% QoQ gain. The latest inflation print shows the YoY rate at 0.1%.

- The ECB’s announcement of further easing steps has raised questions about the SNB’s likely response. The SNB meeting is on 18 September, and the market will likely flirt with the idea of an interest rate cut or a move higher in the EUR-CHF 1.20 floor. We expect neither.

- We continue to believe a move in the floor would be counterproductive by introducing additional complexity into what has been a successful simple strategy. With no rate cut either, the risk that the SNB will be forced to intervene to defend the floor will increase.

- The proximity of the floor, however, is distorting the risk-reward for CHF trades. Very little further strength is likely in the CHF with the SNB so close to the trigger point, so this creates an asymmetry if favour of CHF shorts, not just against the EUR but also against other currencies. CHF-JPY, for example, is already retreating and may soon test support at 112.000, a level it has not closed before this year. USD-CHF also looks likely to challenge resistance at 0.9400,which also marks the 61.8% Fibonacci retracement of the May 2013 – March 2014 downtrend

—

OK, from Deutsche Bank (bolding is mine, again):

- One option for the SNB would be to raise the 1.20 floor. However, this would only serve to replace a durable arrangement with an untested one and also involve large FX intervention.

- Another approach would be to mirror the ECB and cut rates to negative … the SNB could generate a strong FX impact without having to pump further liquidity into a financial system

- The example of Denmark is instructive in that, relatively soon after imposing negative rates in 2012, the National bank was actually able to unwind some of its intervention-related reserve expansion with no impact on the krone

- Negative rates could also have second order advantages for macro-prudential policy. Again, the Danish example suggests that mortgage rates ceased falling after negative rates were imposed and effective borrowing costs rose after banks hiked fees. Costs to the Swiss banking system would appear to be relatively low, with Swiss banks having had considerable time to prepare.

- The bottom line is that the SNB retain plenty of weapons to maintain the EUR/CHF floor … they will remain committed to it. The risks around EUR/CHF therefore remain asymmetric.

–

More on the CHF;