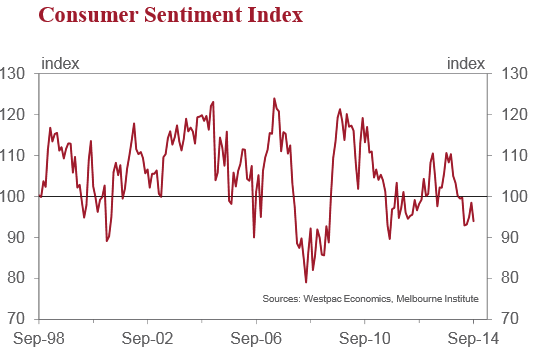

Westpac Consumer Confidence Index (s.a.) for September: -4.6% to 94.0

Main points:

- Consumer Sentiment 94 (-4.6% m/m)

- Current conditions 104.8 (-3.1%)

- Expectations 86.8 (-5.7%)

- Family finances, year ago 83.8 (-4.9%)

- Family finances, year ahead 95.4 (+0.1%)

- Economy 1 year ahead 86.5 (-8.4%)

- Economy 5 years ahead 78.5 (-9.2%)

- Buy major household item 125.7 (-1.9%)

Comment from Westpac Chief Economist Bill Evans:

- This is a surprising and disappointing result

- In effect most of the steady recovery we had seen in the index over the last three months has been eroded

- Of most concern here is the five year economic outlook… Logically, such concerns indicate that households expect any current economic weakness to be sustained for a considerable period.

- The proportion of respondents recalling ‘budget and taxation’ issues is the second highest since the survey was introduced in mid-70s

- Households are … “still quite concerned about the domestic economy and the labor market with these concerns having deteriorated further”

Evans’ outlook for the RBA:

- The Reserve Bank board next meets on October 7. The disappointing results in this survey are consistent with a need for lower interest rates rather than higher interest rates.

- However, the Governor has made it clear that lowering interest rates is not on the policy agenda.In his recent statement following the September Board meeting he reiterated his guidance that “the most prudent course is likely to be a period of stability in interest rates”.

- This survey indicates that households are still concerned about the jobs market. However in a recent speech the Governor noted that “while we may desire to see a faster reduction in the rate of unemployment, further inflating an already elevated level of housing prices seems an unwise route to try to achieve that”.

- Consequently we cannot expect anything apart from a no change decision at the upcoming meeting. We continue to expect that rates will remain on hold for another year until they are raised next August. Of course, issues around the recent Budget, which are still unnerving households, will have been resolved and we expect that households will be encouraged by their much improved balance sheets to lift spending.

–

Yesterday we got business confidence in Australia: National Australia Bank business confidence for August: 8 (vs. prior was 11)

–

AUD/USD down a few points after the release after it had gained a little earlier on along with USD weakness pretty much across the board.